1 Vanguard ETF That Can Serve as a Complete Stock Portfolio

The Motley Fool

MAY 9, 2024

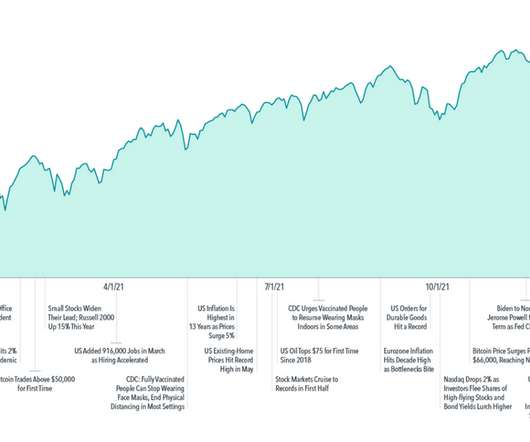

Investing in the stock market can be daunting, especially when it involves picking individual stocks. Among them, the Vanguard Total Stock Market ETF (NYSEMKT: VTI) stands out as a one-stop shop for investors seeking a diversified stock portfolio. Why choose the Vanguard Total Stock Market ETF?

Let's personalize your content