Private equity returning to platforms, with greater efficiency

Private Equity Info

MAY 2, 2024

This article was first published in the Spring issue of Middle Market Dealmaker , the official print publication of the Association for Corporate Growth.

Private Equity Info

MAY 2, 2024

This article was first published in the Spring issue of Middle Market Dealmaker , the official print publication of the Association for Corporate Growth.

The Motley Fool

MAY 3, 2024

Amazon (NASDAQ: AMZN) has been one of the hottest mega-cap stocks on the market. Its shares have soared nearly 20% year to date and are up more than 70% over the last 12 months. The company revealed in its first-quarter update on Tuesday that it plans to increase capital expenditures in the coming quarters. Does this increased spending diminish Amazon's prospects?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A Wealth of Common Sense

APRIL 28, 2024

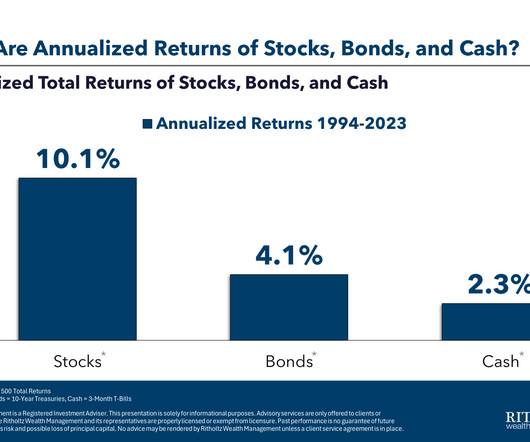

A colleague recently asked me to run the 30 year annual returns for U.S. stocks, bonds and cash. He just wanted the returns. I couldn’t help but slice and dice the numbers and overanalyze the data because that’s what we do here. Let’s dig in. First the annual return numbers for the S&P 500, 10 year treasuries and 3 month T-bills over the 30 years ending in 2023: Some thoughts about these numbers: St.

FinSMEs

APRIL 30, 2024

Jigsaw, a London, UK-based entity management platform focused on corporate infrastructure management, raised $15M in Series A funding. The round was led by Exor Ventures with angels from KKR, Morgan Stanley and Linklaters. The company intends to us the funds to expand operations, its development efforts, and continue to grow its global presence. Founded by […] The post Jigsaw Raises $15M in Series A Funding appeared first on FinSMEs.

The Big Picture

APRIL 28, 2024

In the northeast, Spring has fully sprung. Temps are expected to kiss 80 today, and after a mild winter, we have been enjoying abundant sunshine. The daffodils and tulips are up, the magnolias are blooming, and the pear and cherry trees are explosions of colors! All of that blue sky beckons us to hop in a roadster to enjoy the open road. My first high HP car was a BMW convertible, but the open-top car that set the standard was the 507.

The Motley Fool

MAY 3, 2024

Image source: Getty Images While I'm not a big fan of tipping culture in general, I have to acknowledge the reality around me, so I always try to tip fairly when I'm out. But one conversation I've had with a few folks over the years isn't so much about how much to tip as to what method to give that tip. Specifically, is it better to tip with your credit card as part of your bill, or should you use cash to tip?

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

FinSMEs

MAY 3, 2024

Volta, a Las Vegas, NV-based digital asset company providing Volta Circuit, a multi-signature, non-custodial platform, raised $4.1M in Seed funding. The round wad led by Fika Ventures and Haven Ventures, alongside support from Soma Capital, Dispersion Capital, and Uphonest Capital. The company intends to use the funds to support the launch of its infrastructure technology that expands access and control […] The post Volta Raises $4.1M in Seed Funding appeared first on FinSMEs.

Investment Writing

APRIL 29, 2024

Can you spot what’s wrong in the image below? Please post your answer as a comment. This example has more than one mistake. I post these challenges to raise awareness of the importance of proofreading. The post MISTAKE MONDAY for April 29: Can YOU spot what’s wrong? appeared first on Susan Weiner Investment Writing.

The Motley Fool

MAY 3, 2024

Costco (NASDAQ: COST) and Walmart (NYSE: WMT) are two of the retail sector's most resilient stocks. Both companies weathered fierce competition from Amazon (NASDAQ: AMZN) and expanded as other brick-and-mortar retailers crumbled. Over the past five years, Costco's stock soared 199% as Walmart's stock advanced 78%. The S&P 500 rose only 73% in comparison.

Private Equity Wire

MAY 1, 2024

Wealth management platform Sidekick has added Alessandra Farnum as Alternatives Product Lead. In her new role, Farnum will focus on launching and expanding products and services within the platform’s alternative asset class offering, which aims to include private equity, private credit, venture capital and real estate. Farnum joins Sidekick from her role as Partner at London-based fintech VC fund Mouro Capital, having previously worked at Samsung Ventures.

FinSMEs

MAY 2, 2024

Balcony Technology Group, a Hoboken, NJ-based blockchain infrastructure company, raised an undisclosed amount in Pre-Seed funding. Backers included Blizzard Fund. The company intends to use the funds to expand operations and development efforts. Balcony Technology Group is a technology company committed to modernizing real estate by working with governments and leveraging blockchain technology for secure, […] The post Balcony Technology Group Closes Pre-Seed Funding appeared first on FinSM

A Wealth of Common Sense

MAY 3, 2024

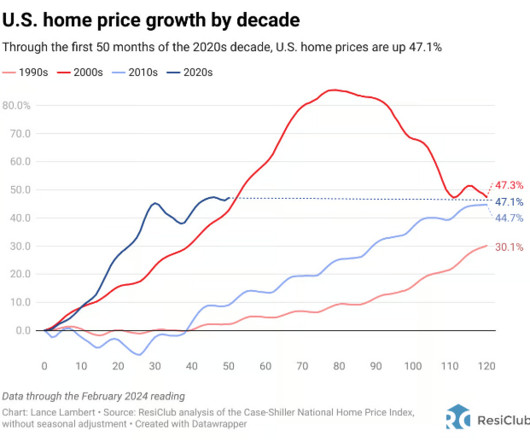

The season 3 finale of Lost was one of the most mind-blowing episodes of television I’ve ever watched. It completely broke the mold of the show from flashbacks to flashforwards. We have to go back is a line that’s etched into my memory for good: Subscribe to The Compound so you never miss an episode. Further Reading: Who is Buying a House in This Market?

The Motley Fool

MAY 3, 2024

Artificial intelligence (AI) has become all the rage since early 2023, so it's easy to forget that these sophisticated algorithms have been around in some form or another for decades, helping early adopters become some of the world's most valuable companies. Microsoft tops the list at $2.9 trillion, having wrested the crown from Apple , which clocks in at No. 2 at $2.6 trillion.

Private Equity Wire

MAY 3, 2024

CVC Credit, the €40bn global credit management business of CVC Capital Partners, has closed Cordatus XXXI, its fourth new Collateralised Loan Obligation (CLO) this year, at more than €440m (c$475m). The new vehicle, which was tightly priced despite broader market volatility, brings CVC’s aggregate value of newly priced CLOs in 2024 to c€1.8bn (c$2.0bn).

FinSMEs

MAY 2, 2024

Indicium, a NYC- and São Paulo, Brazil-based data and AI consultancy, raised a $40M investment from Columbia Capital. The company intends to use the funds to further expand its US operations (which currently represents 30% of its revenue) and create a US HQ in New York, building its local team. Led by Matheus Dellagnelo (CEO), […] The post Indicium Raises $40M Investment from Columbia Capital appeared first on FinSMEs.

Financial Times M&A

MAY 1, 2024

FTC expected to raise concerns over Scott Sheffield’s messages with Opec as it moves to approve $60bn deal

The Motley Fool

MAY 3, 2024

Palantir Technologies (NYSE: PLTR) , one of the forerunners of modern artificial intelligence (AI), is scheduled to report the results of its fiscal 2024 first quarter (ended March 31) after market close on Monday. Wall Street will be waiting with bated breath to review its performance -- and with good reason. The stock has surged roughly 250% since the beginning of last year, driven higher by Palantir's improving financial results and the profit potential resulting from generative AI.

Private Equity Wire

MAY 3, 2024

San Francisco-based investment firm Knox Lane has acquired a majority stake in All Star Healthcare Solutions, a US full-service healthcare staffing firm focused on the locum tenens market. Terms of the transaction have not been disclosed. All Star’s founders and management team will reinvest alongside Knox Lane and continue to own a significant minority stake in the company going forward.

FinSMEs

MAY 1, 2024

RunReveal, an Austin, TX-based provider of a SIEM built to detect threats, raised $2.5M in Seed funding. The round was led by Costanoa Ventures. The company intends to use the funds to scale its team and roll out additional offerings. Founded in 2023 by Evan Johnson and Alan Braithwaite, RunReveal is a security data platform […] The post RunReveal Raises $2.5M in Seed Funding appeared first on FinSMEs.

Financial Times M&A

MAY 2, 2024

The $335bn manager already has $14bn in active fixed-income ETFs in the US and is eyeing rapid growth in demand globally

The Motley Fool

MAY 3, 2024

XRP (CRYPTO: XRP) , the native cryptocurrency of the Ripple payment protocol network, reached its all-time high of $3.84 on Jan. 4, 2018. That represented a whopping gain of nearly 40,000% over the previous 12 months. But today, XRP trades at about $0.50. Like many smaller altcoins, XRP lost its luster as rising interest rates chilled the cryptocurrency market.

Private Equity Wire

MAY 2, 2024

Boston-headquartered private equity firm Advent International has entered into discussions with the Government of Oman over a potential injection of fresh capital into state-owned OQ Chemicals in exchange for a majority stake in the company, according to a report by Bloomberg. The report cites unnamed people familiar with the matter in revealing that Advent is considering investing up to $250m in a deal that would see it take control of the business, with current owner and state energy company O

FinSMEs

MAY 1, 2024

Unicorn, a Chicago, IL-based provider of a tech-enabled platform for spirits and wine collectors globally, raised $5.8M in Seed funding. Backers included Protagonist, Blue Equity, 640 Oxford, Middleton Partners, and angels Jason Pritzker, Edward Lando, Andrew Macdonald, Ken Fredrickson (Master Sommelier), the Wirtz and Merinoff Families, and co-founders of VII(N)-The Seventh Estate: Asani Swann and NBA All-Star and entrepreneur, Carmelo Anthony.

Financial Times M&A

MAY 2, 2024

CEOs weighing mergers may think twice after FTC bars industry veteran from Exxon’s board

The Motley Fool

MAY 3, 2024

If you've ever wondering why more than 40,000 people flock to Berkshire Hathaway 's (NYSE: BRK.A) (NYSE: BRK.B) annual shareholder meeting each year, look no further than the track record of longtime CEO Warren Buffett. Since the affably named "Oracle of Omaha" became CEO in the mid-1960s, he's overseen a greater-than 4,900,000% aggregate return in his company's Class A shares (BRK.A).

Private Equity Wire

MAY 2, 2024

Strong asset sales across Carlyle Group’s private equity portfolio saw the alternative asset management firm’s distributable earnings jump by nearly 59% year-on-year in the first three months of the year, according to a report by Reuters. Distributable earnings – the cash used to pay dividends to shareholders – rose to $431.3m from $271.6m in Q1 2023 which equates to $1.01 per share, ahead of the average Wall Street analyst estimate of 94 cents, according to LSEG data.

FinSMEs

APRIL 30, 2024

Corelight, a San Francisco, CA-based open network detection and response (NDR) company, raised $150M in Series E funding. The round was led by Accel, with participation from Cisco Investments and CrowdStrike Falcon Fund. The company intends to use the funds to accelerate its AI-driven security innovation, cloud-native security capabilities, and data fusion partnerships with cybersecurity platforms to deliver enhanced […] The post Corelight Raises $150M in Series E Funding appeared first on

Financial Times M&A

APRIL 28, 2024

Company weighs deal with Skydance as Sony and Apollo prepare counter-offer

The Motley Fool

MAY 3, 2024

Vanguard exchange-traded funds (ETFs) are excellent ways to get low-cost exposure to a variety of stocks. And while investors may be familiar with one of the more well-known Vanguard funds like the Vanguard S&P 500 ETF , Vanguard Growth ETF , or the Vanguard Value ETF , there may be even better funds out there for generating reliable passive income With expense ratios of 0.10% or less, here's why the Vanguard High-Dividend Yield ETF (NYSEMKT: VYM) , Vanguard Dividend Appreciation ETF (NYSEMK

Private Equity Wire

MAY 2, 2024

Global investment banking advisory firm Lincoln International has added Dr Simon von Witzleben as a Managing Director within its valuations & opinions group in London. In his new role, Witzleben will lead the provision of fairness and solvency opinion advisory services to European private equity firms, public and private companies and boards of directors.

FinSMEs

APRIL 30, 2024

Elisity, a San Jose, CA-based company which specializes in identity-based microsegmentation, raised $37M in Series B funding. Backers included Insight Partners, with participation from AllegisCyber Capital and Two Bear Capital. The company intends to use the funds to extend its platform’s artificial intelligence (AI) capabilities, fully leveraging organizations’ device identity data to anticipate and pre-empt […] The post Elisity Raises $37M in Series B Funding appeared first on FinSMEs.

The Big Picture

MAY 2, 2024

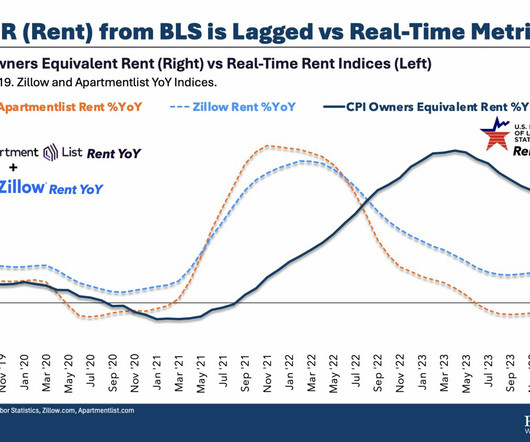

The Fed held its benchmark Federal-Funds rate steady yesterday at 5.25% – 5.5%, leaving the possibility of cuts in the future. Jerome Powell repeated his “ Data Dependent ” mantra. “Persuasive evidence” that higher interest rates were no longer necessary to bring down inflation is what the FOMC wants, and today I want to share a few pieces of that evidence.

The Motley Fool

MAY 2, 2024

Social Security income is protected from inflation by annual cost-of-living adjustments (COLAs). Benefits got an 8.7% COLA last year and a 3.2% COLA this year, both above the 10-year average of 2.3%. But many Social Security beneficiaries are still feeling financial pressure in the current economic environment. The 2024 Retirement Confidence Survey (RCS) conducted by the Employee Benefit Research Institute, a nonprofit group, found that 56% of retired workers expect to make substantial spending

Private Equity Wire

MAY 3, 2024

London-based card reader maker SumUp has secured a €1.5bn private credit loan package from a group of lenders led by Goldman Sachs. Other participants include BlackRock, Apollo Global Management, Oaktree Capital Management and Vista Credit Partners. According to a press statement, cash from the round – one of the largest European private credit deals of its kind in recent years – will be used to “refinance existing debt and seize global growth opportunities” A report from Reuters cit

Let's personalize your content