A Short History of Stocks

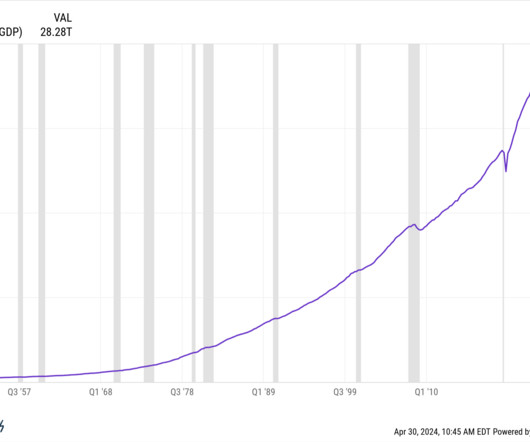

The Big Picture

APRIL 11, 2024

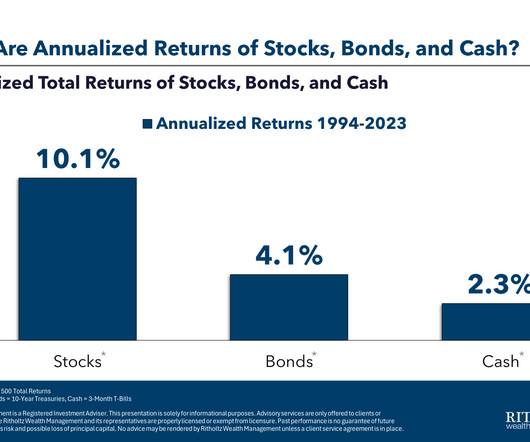

Confused about where we are today? A favorite exercise is to go back to first principles to consider how we got to where we are. (That is a favorite way to find fresh insights). On the equity side, you have to go back a century or so. Equities were considered speculative endeavors, best suited for gamblers and punters. The exceptions? A handful of “Widows & Orphan” stocks, like Ma Bell, some railroads, utilities and the rare bank that was not suffering regular runs.

Let's personalize your content