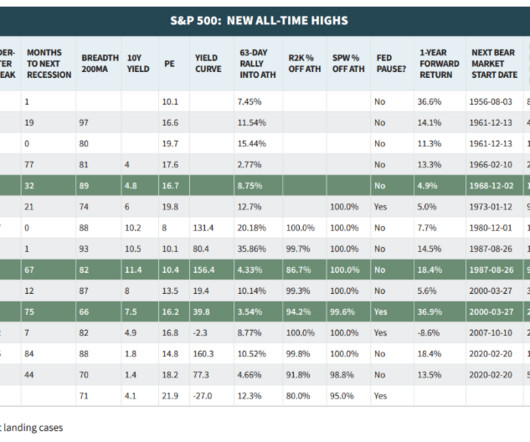

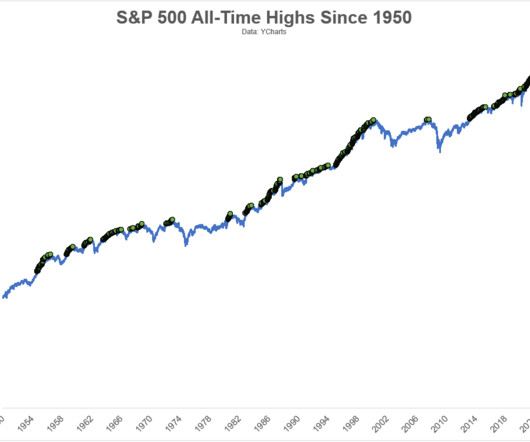

All-Time Highs Are Historically Bullish

The Big Picture

FEBRUARY 22, 2024

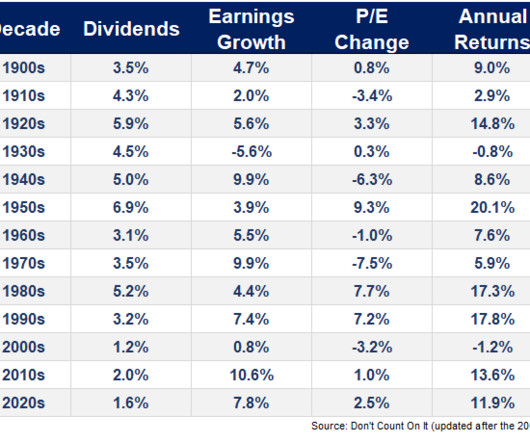

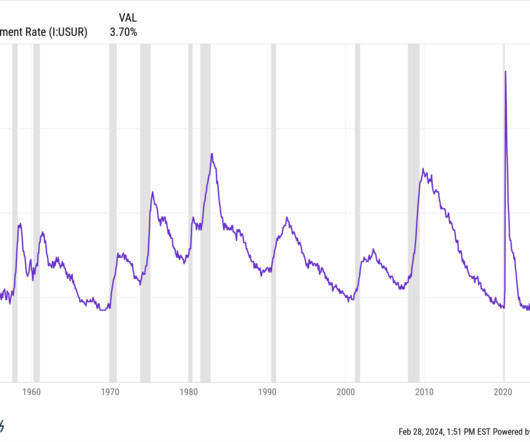

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the table above, via Warren Pies. He spoke with Batnick and Josh earlier this month. Going back to 1954, markets are always higher one year later – the only exception was 2007. That was after housing had peaked, subprime mortgages were defaulting, and the great financial crisis was about to start.

Let's personalize your content