Is Matterport a Worthy Merger Arbitrage Play?

The Motley Fool

MAY 28, 2024

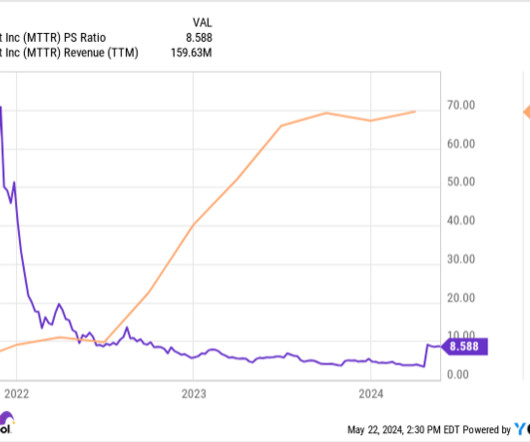

As a result, the proposed acquisition creates an opportunity known as merger arbitrage -- a short-term investing strategy where you buy stocks of companies trading below their acquisition prices. or more 0.02906 shares Matterport's Merger Arbitrage Opportunity As of this writing, Matterport trades for roughly $4.40

Let's personalize your content