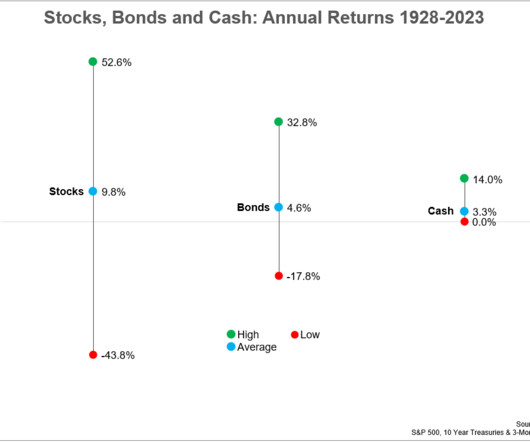

This is the Best U.S. Economy Since the 1990s

A Wealth of Common Sense

JANUARY 26, 2024

As millennials reach middle age (hand up), prepare yourself for a wave of 1990s nostalgia. Remember MTV? Remember life before smartphones and social media? Remember rap groups? Remember life before everyone was forced to care about politics? Remember Saved by the Bell? Remember going to Blockbuster on a Friday night to pick out a movie? Finance people also have an affinity for the 1990s economy.

Let's personalize your content