Tesla Sent a Clear Message to Wall Street on Tuesday

The Motley Fool

APRIL 24, 2024

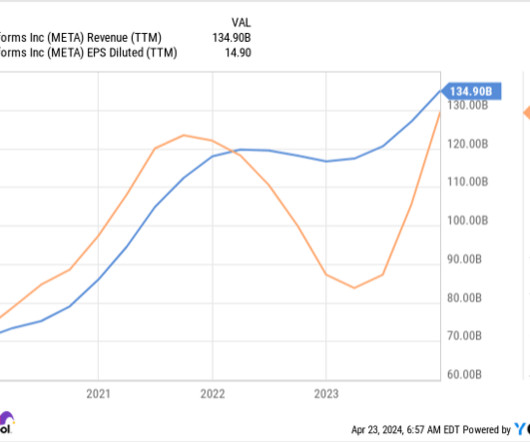

In this video, I will go over Tesla 's (NASDAQ: TSLA) first-quarter earnings. The company reported a double miss but shared some exciting news about its future. *Stock prices used were from the trading day of April 23, 2024. The video was published on April 24, 2024. Where to invest $1,000 right now When our analyst team has a stock tip, it can pay to listen.

Let's personalize your content