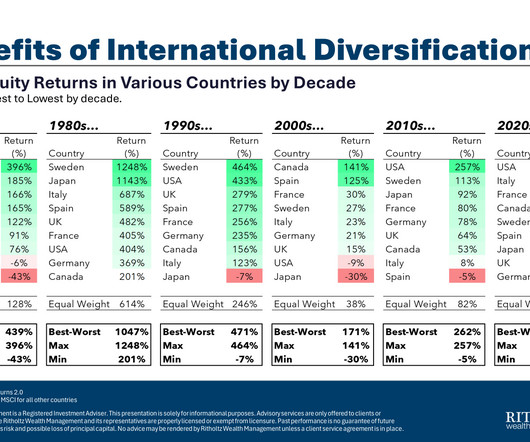

Diversification is About Decades

A Wealth of Common Sense

MAY 14, 2024

A lot of investors have abandoned international diversification (or at least strongly considered it) in recent years. I understand why this is happening. The U.S. stock market has destroyed all comers ever since the Great Financial Crisis ended. Since 2009, a total U.S. stock market index fund is up more than 660% while a total international index fund is up more like 180%.

Let's personalize your content