Is Auto Insurance Becoming a Crisis?

A Wealth of Common Sense

APRIL 16, 2024

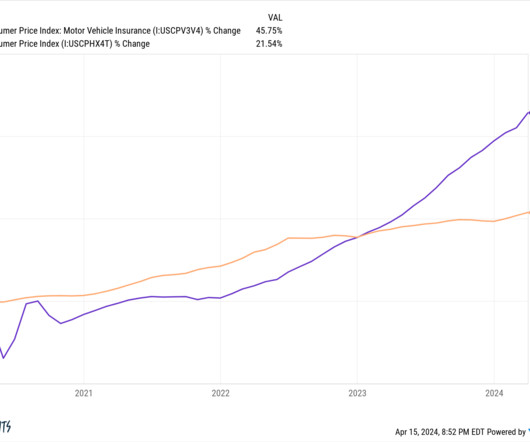

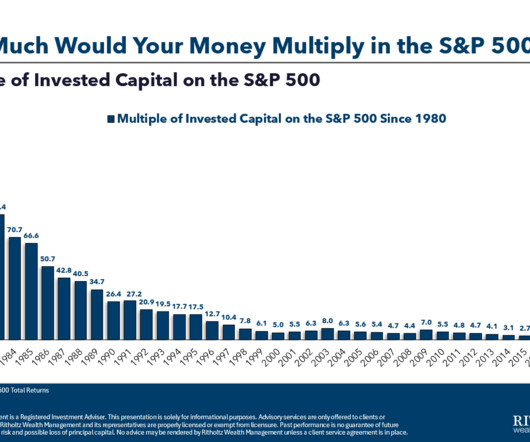

I was perusing the BLS data following the inflation release last week and one number sticks out like Victor Wembanyana standing next to a group of kindergartners. Auto insurance was up 22% over the previous 12 months versus an overall inflation rate of 3.5%. Look at the change in auto insurance rates these past few years: It’s like a meme stock.

Let's personalize your content