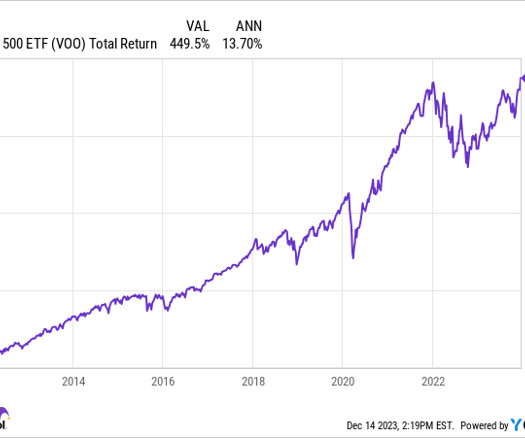

How Should a Beginner Invest in Stocks? Try This ETF.

The Motley Fool

MAY 29, 2024

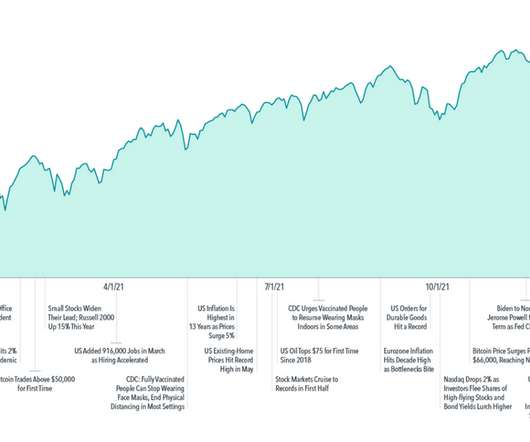

The stock market is a great tool for protecting and growing your hard-earned nest egg, and by deciding to take the leap, you already have an advantage. Nearly 30% of Americans don't invest in the stock market at all , according to Gallup data. What's an exchange-traded fund? stock market.

Let's personalize your content