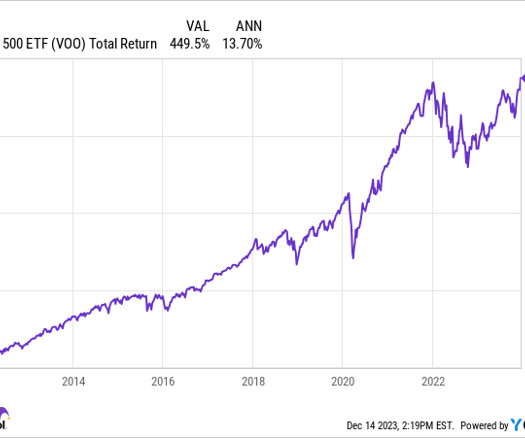

This ETF Has Consistently Outperformed 88% of Mutual Funds Over the Past Decade

The Motley Fool

MAY 16, 2024

Finding an ETF or mutual fund that can consistently beat the market year in and year out is practically impossible. Wall Street is full of sharp minds that are often willing to share their investment insights and strategies with everyday investors through a mutual fund. That's not for lack of options.

Let's personalize your content