4 Economic Charts That Might Surprise You

A Wealth of Common Sense

MAY 19, 2024

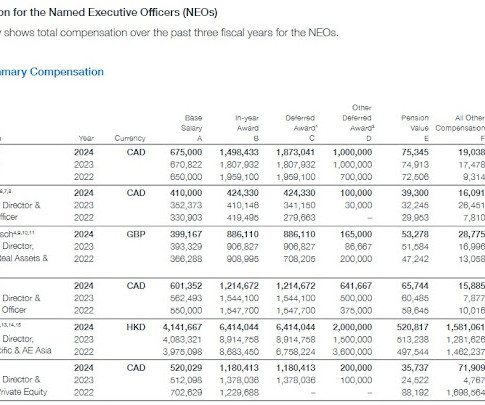

Four charts about the economy you might find surprising: 1. Wages are cumulative too. The Congressional Budget Office released new research comparing inflation on a basket of goods and services households at different income levels consume between now and 2019 along with changes in wages. Here’s the chart: And the explanation: For households in every quintile (or fifth) of the income distribution, the share of inc.

Let's personalize your content