Charles Schwab Tops Q2 Estimates Thanks to Management Fees, Despite Interest Income

The Motley Fool

JULY 19, 2023

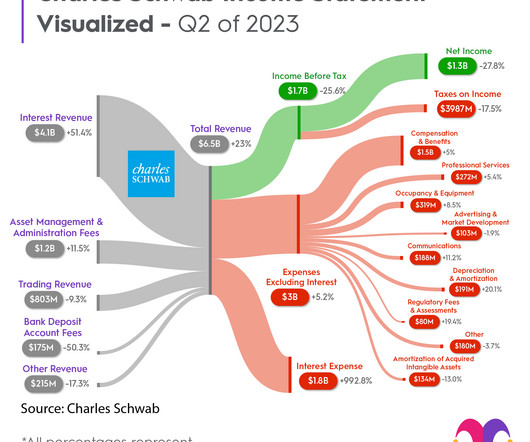

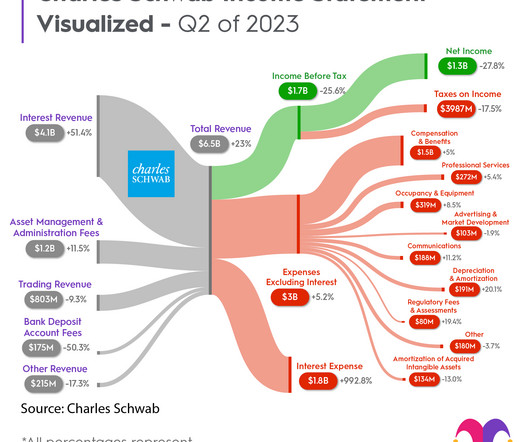

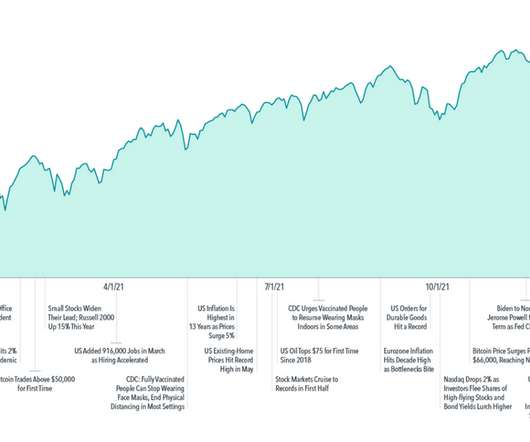

But, net customer gains mean it's at least generating more management fee revenue now than it was at this point in 2022. In line with results from some other banks and brokers, the firm is reaping the benefits of a stabilizing, mostly bullish stock market and higher interest rates even as its own interest expenses soar.

Let's personalize your content