Why I Just Added This Ultra-High-Yield Dividend ETF to My Retirement Account

The Motley Fool

APRIL 27, 2024

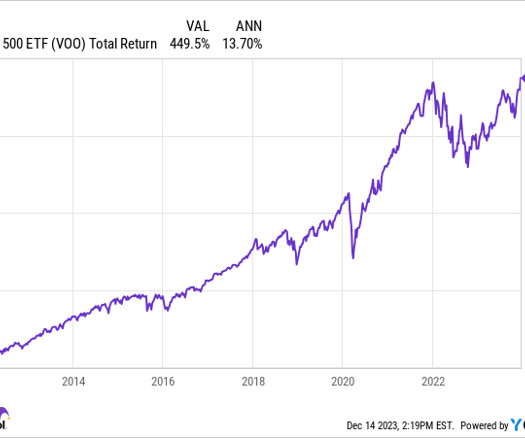

It certainly delivers a premium income yield these days: Data source: JPMorgan Asset Management. They vary from month to month based on the income the ETF generates: JEPQ Dividend data by YCharts The actively managed fund charges investors a fairly reasonable ETF expense ratio of 0.35%. of its net assets Apple : 5.7%

Let's personalize your content