1 Magnificent S&P 500 Dividend Stock Down 23% to Buy Right Now

The Motley Fool

FEBRUARY 26, 2024

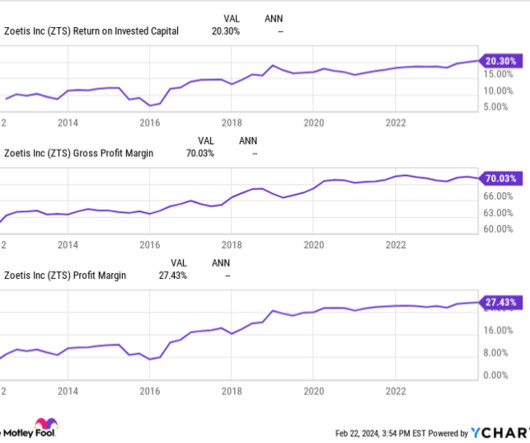

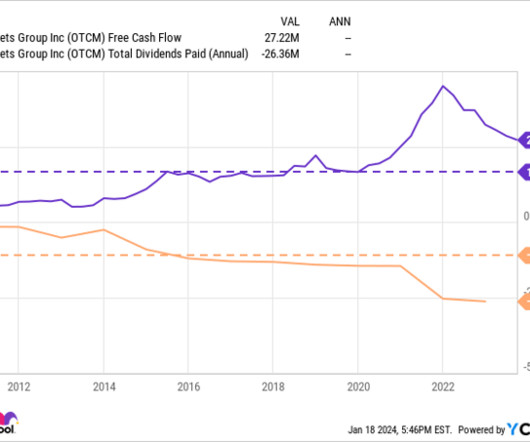

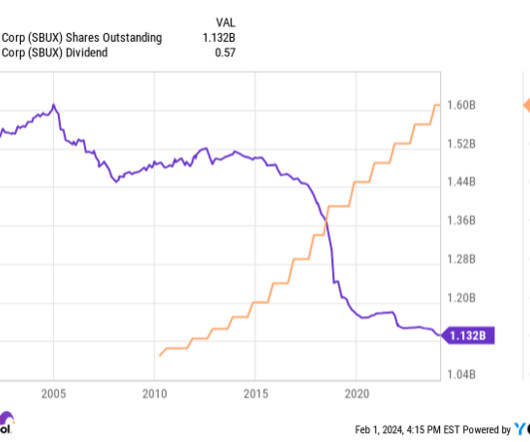

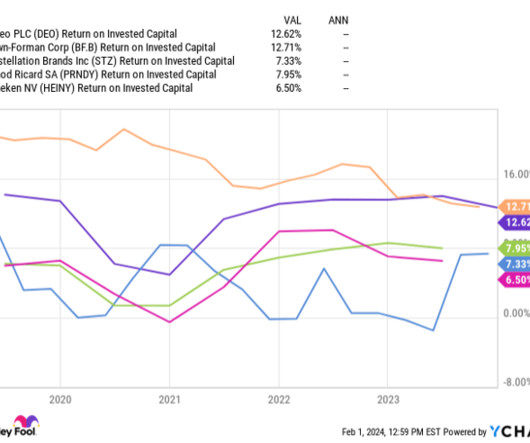

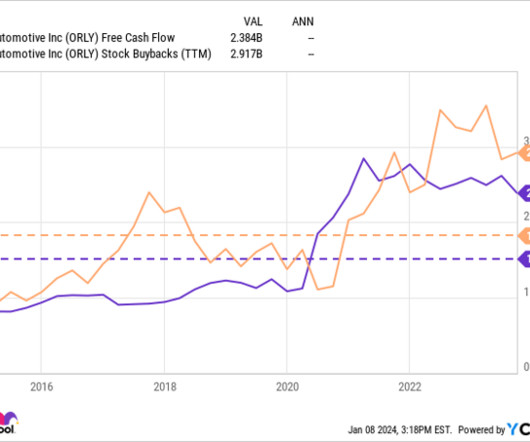

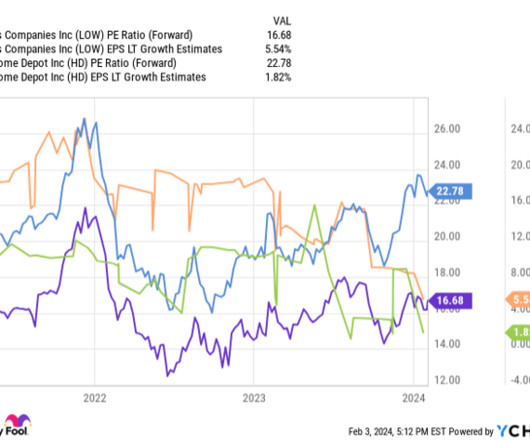

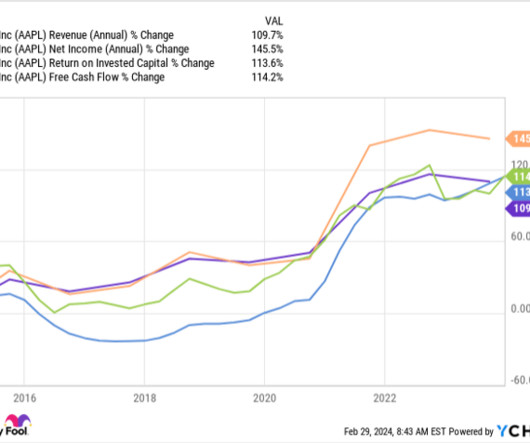

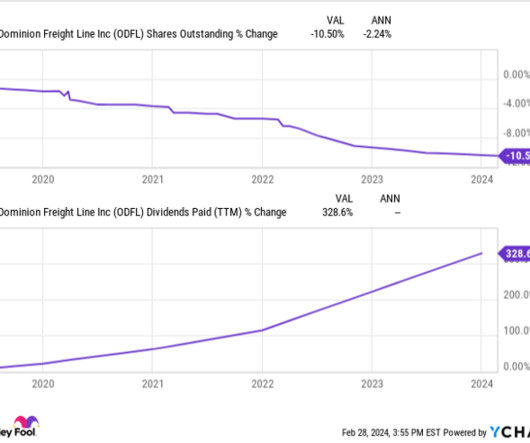

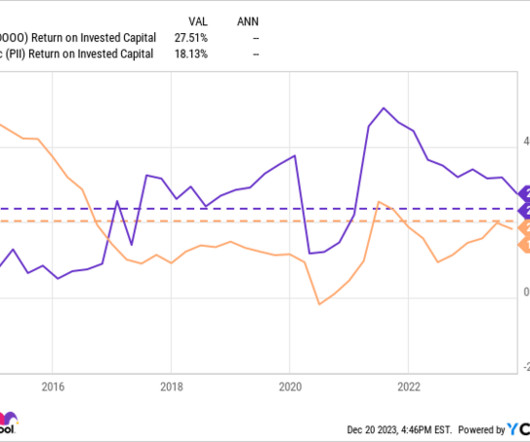

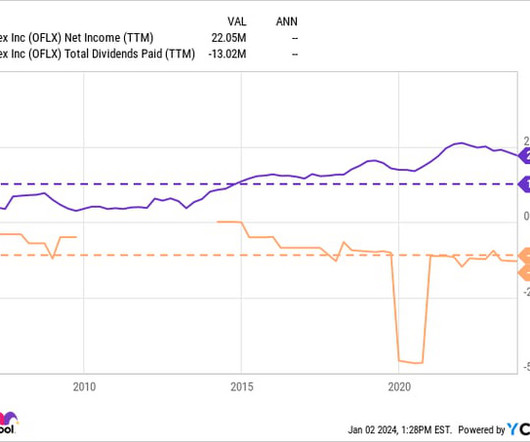

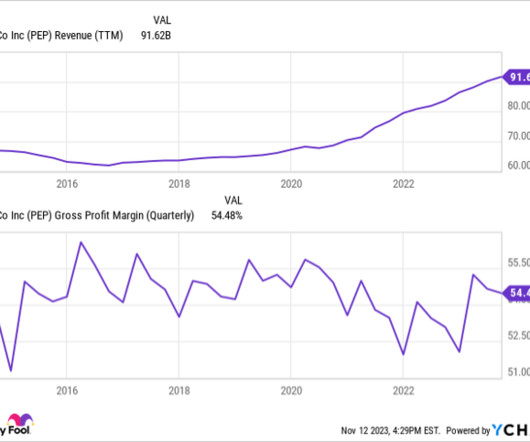

Three examples are businesses with consistently growing dividend payments and a low payout ratio, steady share repurchases, and a high and rising return on invested capital. Particular financial metrics have been proven to indicate market-beating potential when analyzing stocks.

Let's personalize your content