Beat the Dow Jones With This Cash-Gushing Dividend Stock

The Motley Fool

NOVEMBER 12, 2023

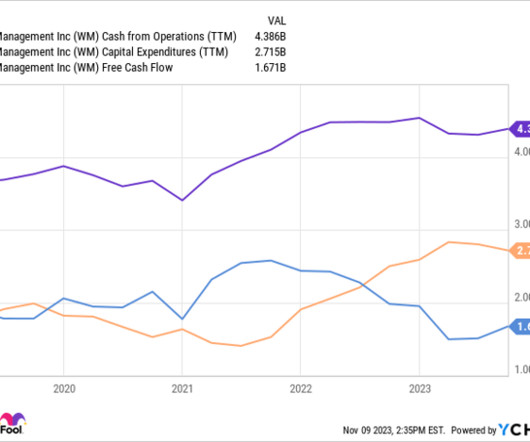

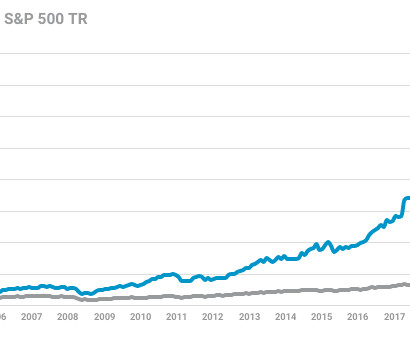

WM Cash from Operations (TTM) data by YCharts Despite this ramped-up capex spending, Waste Management remains FCF positive, returning $283 million in dividends and $370 million in stock buybacks to its shareholders during the third quarter. ROIC shows that it is the best in its industry at reinvesting in its business.

Let's personalize your content