5 Reasons to Buy Enterprise Products Partners Stock Like There's No Tomorrow

The Motley Fool

MAY 29, 2024

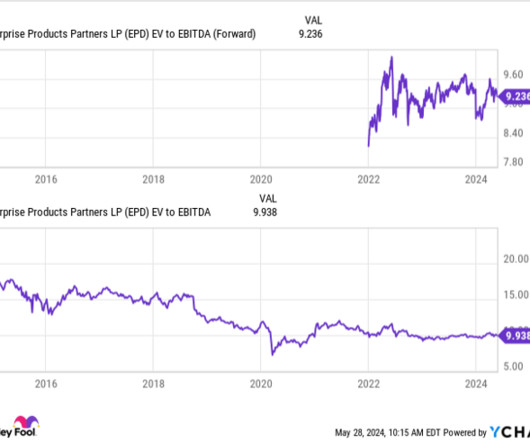

The company generates a lot of cash flow, and has historically taken a conservative posture with leverage , which is also why it has been able to consistently increase its distribution. Leverage currently stand at 3, which is low for the midstream industry. if you invested $1,000 at the time of our recommendation, you’d have $697,878

Let's personalize your content