Enterprise Products Partners Is Set to Enter Growth Mode. Is It Time to Buy This Dividend Stock With a 7.3% Yield?

The Motley Fool

MAY 11, 2024

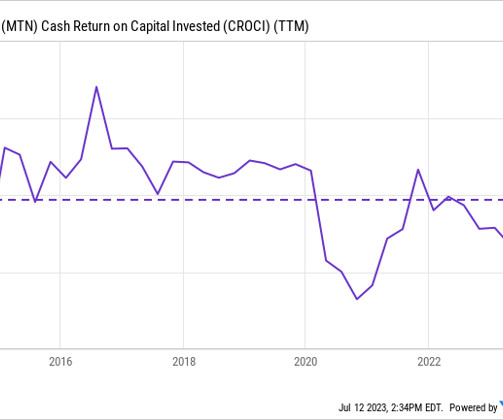

Enterprise ended the quarter with leverage of 3x. It defines leverage as net debt adjusted for equity credit in junior subordinated notes (hybrids) divided by adjusted EBITDA. Enterprise has averaged about a 13% return on invested capital over the past five years. after increasing its quarterly distribution by 5% to 51.5

Let's personalize your content