5 Retirement Hacks Everyone Should Leverage in 2024

The Motley Fool

DECEMBER 17, 2023

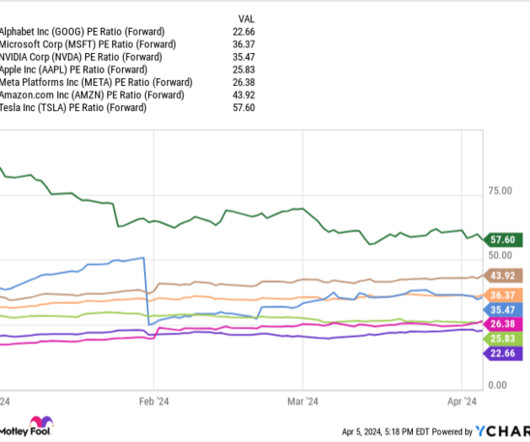

They just revealed what they believe are the ten best stocks for investors to buy right now. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor , has tripled the market.* and Walmart wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Let's personalize your content