Enterprise Products Partners Is Set to Enter Growth Mode. Is It Time to Buy This Dividend Stock With a 7.3% Yield?

The Motley Fool

MAY 11, 2024

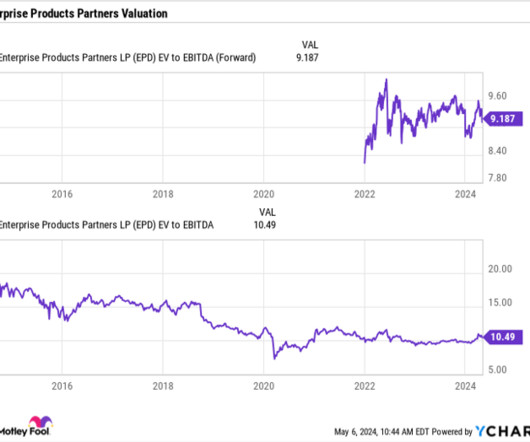

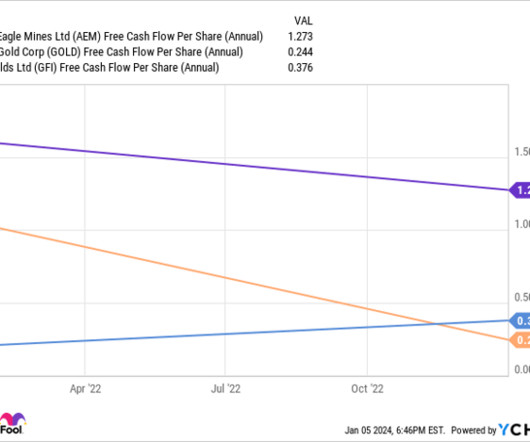

Its adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ), meanwhile, rose 6% to nearly $2.5 It defines leverage as net debt adjusted for equity credit in junior subordinated notes (hybrids) divided by adjusted EBITDA. The company is also in solid financial shape concerning its debt load.

Let's personalize your content