Walgreens Boots Stock Just Hit Its Lowest Level Since 1998. Time to Buy the Dip or Stay Away?

The Motley Fool

MAY 28, 2024

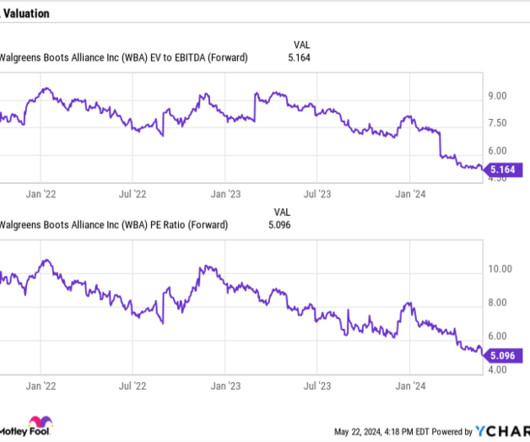

billion in net debt, not including operating leases, an ill-advised investment was not a good use of cash. Healthcare segment was able to flip to positive adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ) of $17 million and a modest adjusted operating loss of $34 million. For a company with $8.8

Let's personalize your content