2 Artificial Intelligence ETFs to Buy Before the Stock Market Makes a New All-Time High

The Motley Fool

MAY 10, 2024

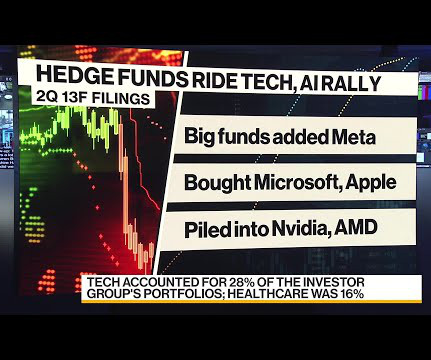

But it's currently in the midst of a modest sell-off, which started at the end of March, as investors navigate headwinds relating to inflation and interest rates. That title goes to Alphabet, with its Class A and Class C shares representing a combined 10.8% It has generated a compound annual return of 10.6%

Let's personalize your content