How to Invest Your 401(k) Money if You're 30 Years Old

The Motley Fool

MAY 8, 2024

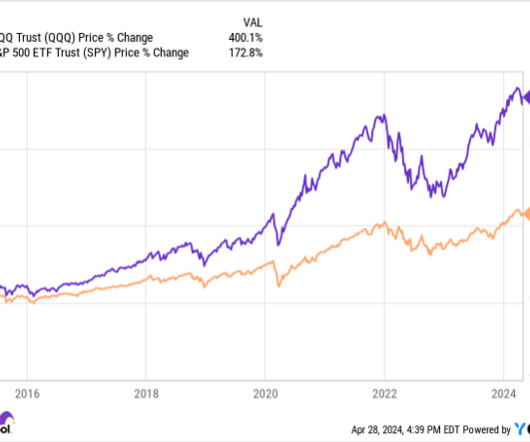

Image source: Getty Images If you're 30 years old (or close to age 30), you're at a unique stage of life as an investor. This is also called "asset allocation." Deciding on your asset allocation helps determine where your investment dollars go -- into stocks, bonds, or other investment options.

Let's personalize your content