Will My Social Security Benefit Increase at My Full Retirement Age?

The Motley Fool

APRIL 27, 2024

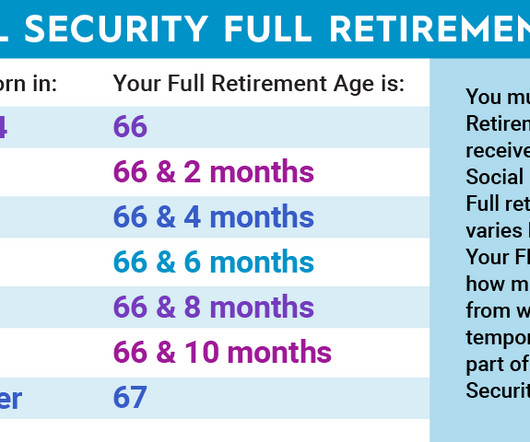

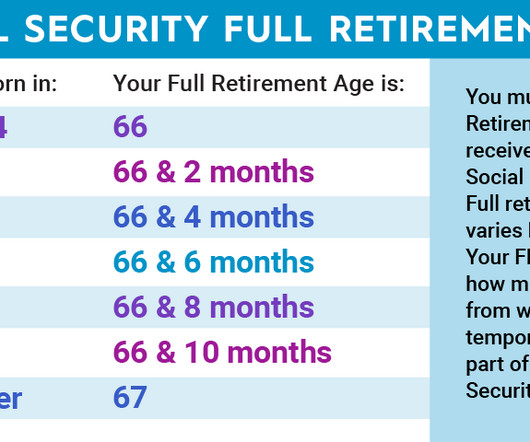

Social Security is poorly understood, even though it forms the backbone of most Americans' retirement plans. For example, many believe that the government automatically increases your Social Security benefit once you reach your full retirement age (FRA). What is full retirement age anyway?

Let's personalize your content