The Best Reason to Take Social Security Long Before Age 70

The Motley Fool

APRIL 28, 2024

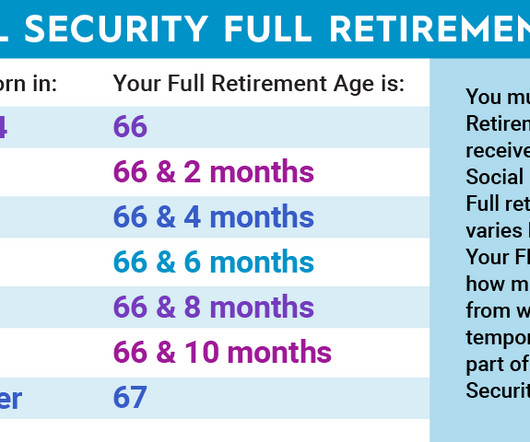

Retirement planning involves a long list of important decisions. From where to retire to your retirement savings withdrawal strategy to your desired retirement plans, there's no shortage of decisions. However, one of the more important decisions anyone will make about retirement is when to claim Social Security.

Let's personalize your content