ATM: Mutual Funds vs. ETFs

The Big Picture

DECEMBER 14, 2023

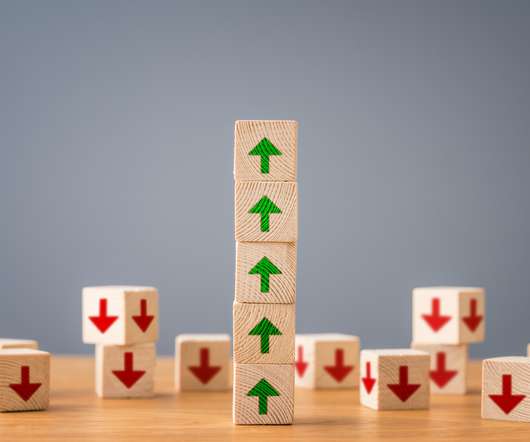

At the Money: Mutual Funds vs. ETFs with Dave Nadig, Financial Futurist for Vetta Fi (December 13, 2023) What’s the best instrument for your investments? Mutual funds or ETFs? But over the past few decades the mutual fund has been losing the battle for investors attention. Dave Nadig : Absolutely not!

Let's personalize your content