The 3 Biggest Tax Breaks I've Ever Gotten

The Motley Fool

MARCH 3, 2024

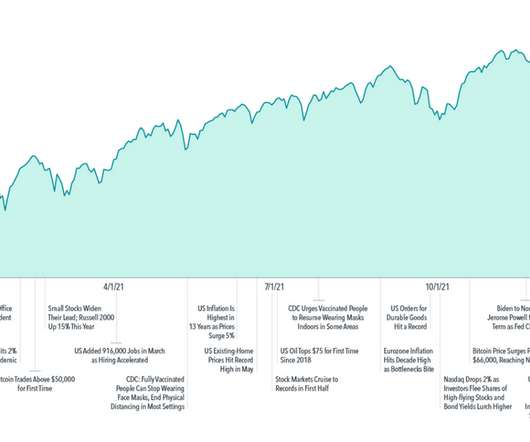

Image source: Getty Images The goal when filling out your federal income tax return should be to pay what you owe -- but not a penny more. You can make sure this happens by taking advantage of the numerous tax deductions, credits, and other incentives in the lengthy U.S. tax code to make sure your bill is as low as possible.

Let's personalize your content