$7,000 Invested in These 3 ETFs in a Roth IRA in 2024 Could Turn Into More Than $120,000 of Tax-Free Retirement Savings

The Motley Fool

JANUARY 24, 2024

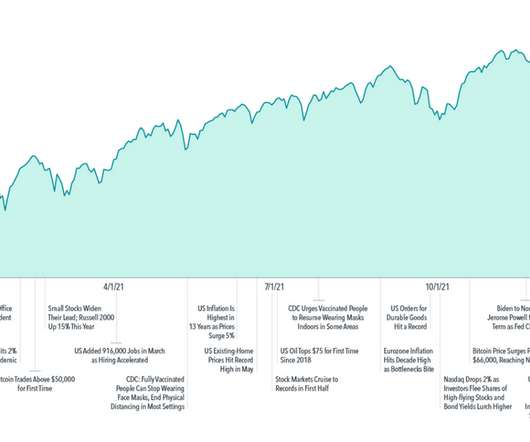

It's a common misconception that to build wealth in the stock market over the long term, you need to invest in a portfolio of individual stocks. While it's certainly possible to achieve superior returns with individual stocks, it isn't a requirement for building wealth. Here are three to consider.

Let's personalize your content