Meet the Two Super Safe Stock Market Sectors That Just Hit 52-Week Highs

The Motley Fool

MAY 15, 2024

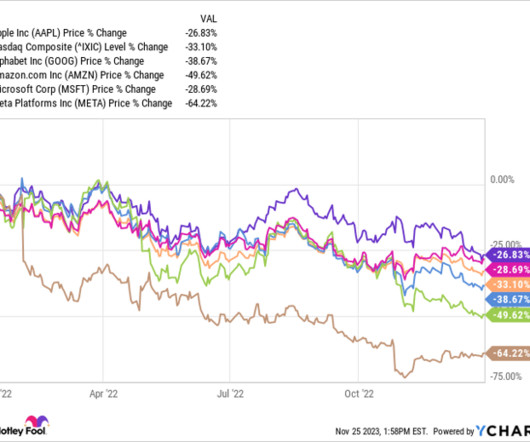

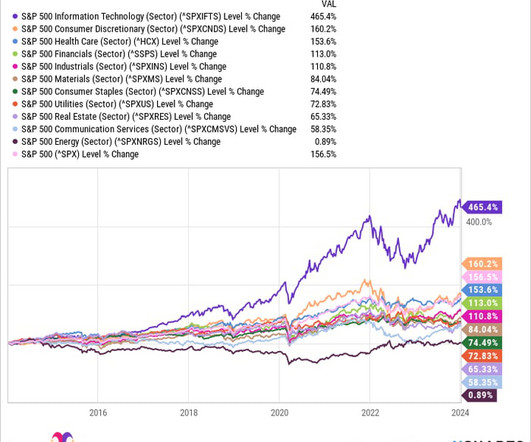

Stock market indices like the S&P 500 and Nasdaq Composite are excellent benchmarks for tracking how the broader market is doing. But so are stock market sectors. Each component of the S&P 500 is assigned to one of 11 sectors. Image source: Getty Images. Both funds yield 3.3%

Let's personalize your content