The New Year Is Here and Disney Has an Exciting Present for Shareholders

The Motley Fool

DECEMBER 27, 2023

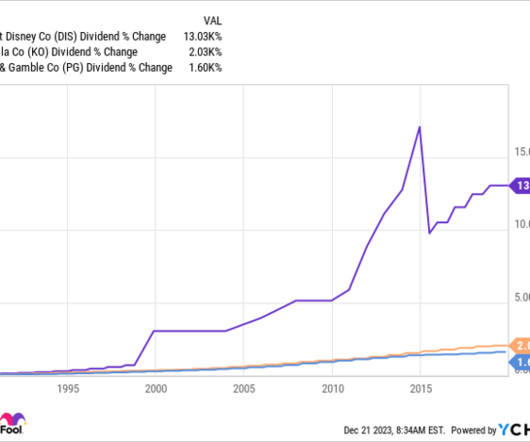

10 to shareholders as of Dec. Disney is an old stock, having traded over the counter since 1940 before an initial public offering in 1957. He's aiming to get streaming spending under control, boost profits, and reward shareholders. Management said that it would issue a dividend of $0.30

Let's personalize your content