What is the Fed Doing?

A Wealth of Common Sense

SEPTEMBER 25, 2022

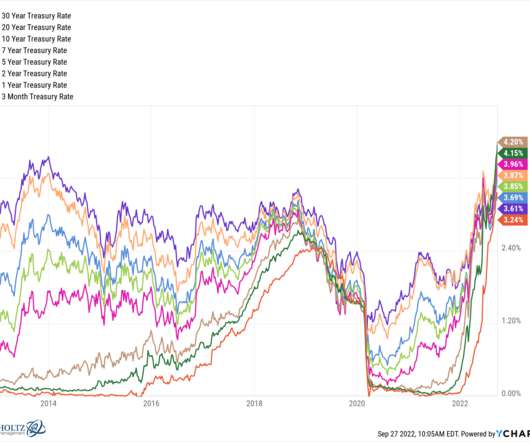

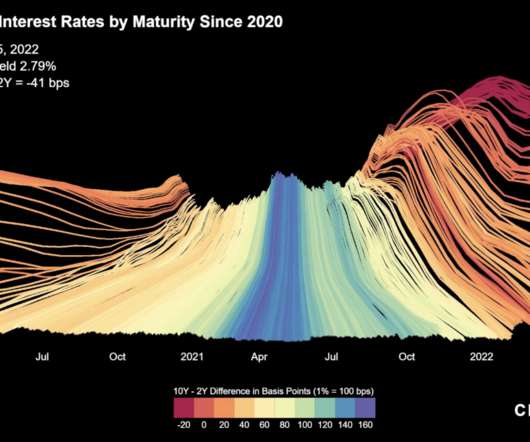

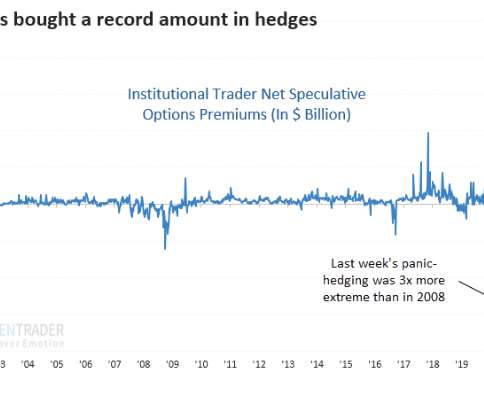

Don’t fight the Fed used to be a positive slogan. That’s not the case anymore. If anything, it feels like the Fed wants to fight us, all of us, including the stock market and the economy. The Fed is actively trying to crash the stock market, break the housing market and push the economy into a recession. How do I know this? Because Fed officials are literally telling us this every time they speak.

Let's personalize your content