When Will We See New Highs Again in the Stock Market?

A Wealth of Common Sense

NOVEMBER 19, 2023

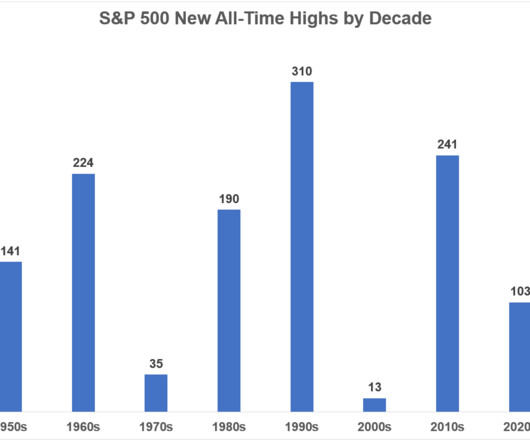

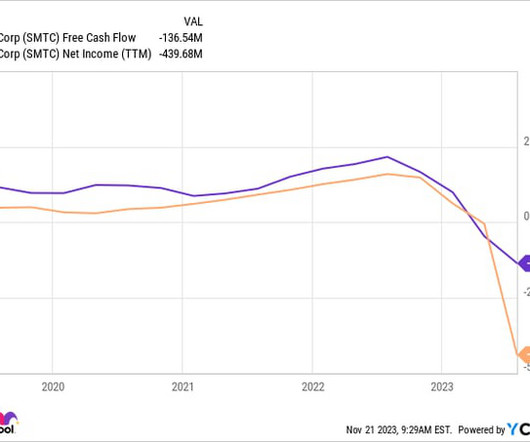

The S&P 500 last hit a new all-time high on January 3, 2022. The market has been slowly but surely working its way back to new highs but we’ve been underwater for nearly two years now: The market is within spitting distance of new highs but stocks have gone nowhere for almost two years. We’re a little less than four years into the 2020s and half of those years have seen no new highs but there have already.

Let's personalize your content