You weren’t supposed to see that

The Reformed Broker

OCTOBER 3, 2022

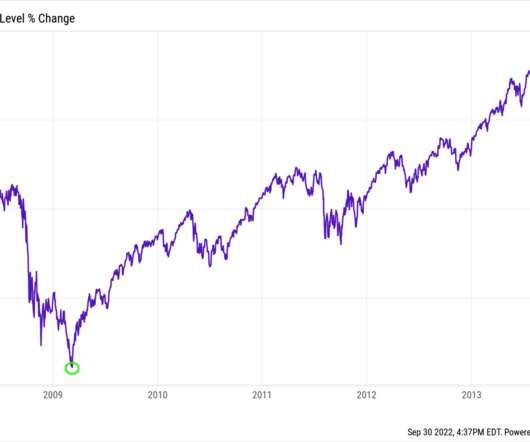

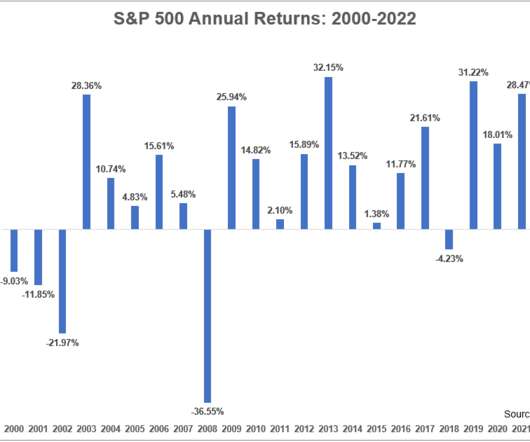

I’m going to tell you a quick story in the order in which it happened. You were there. You will be familiar with the sequence of these events. But you may not have reached the shocking conclusion that I have. At least not yet. Wait for it… Our story begins in 2019… It was the best of times, it was the best of times. The tail end of a decade of uninterrupted asset price appreciation for the top decile of.

Let's personalize your content