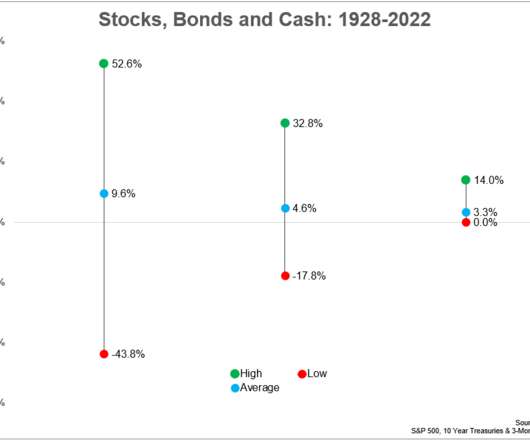

Stock, Bond & Cash Returns Over the Past 95 Years

A Wealth of Common Sense

JANUARY 29, 2023

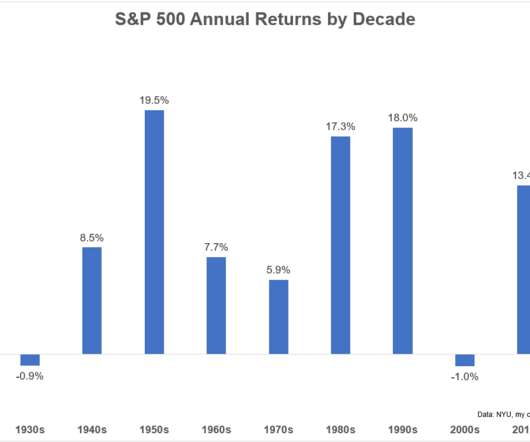

Each year Aswath Damodaran at NYU kindly updates the annual returns for stocks (S&P 500), bonds (10 year Treasuries) and cash (3-month T-bills) going back to 1928. I love this data because stocks, bonds and cash are the building blocks of asset allocation.1 Sure, you can add other asset classes and strategies but those three are where most investors should start when it comes to figuring out your portfolio mix.

Let's personalize your content