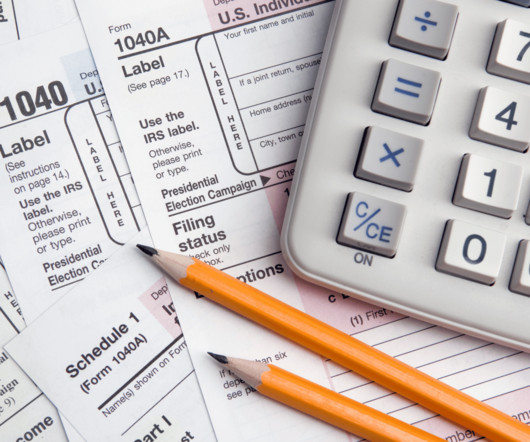

CPI = 5.0% (Time to Stop Raising Rates)

The Big Picture

APRIL 12, 2023

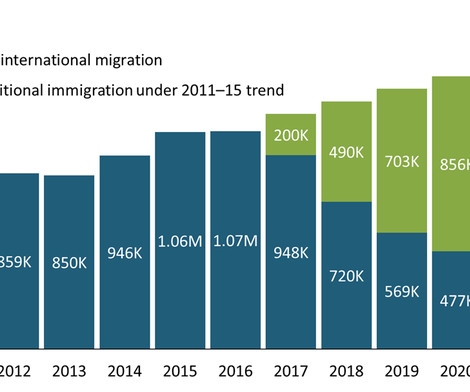

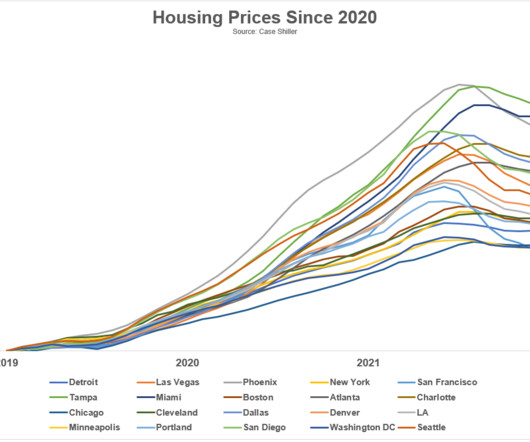

U.S. Bureau of Labor Statistics: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a seasonally-adjusted basis, after increasing 0.4 percent in February. Over the last 12 months, the all items index increased 5.0 percent before seasonal adjustment. ( April 2023 ) As much as I want to jump up and down about 0.1% seasonally adjusted (after a 0.4% prior month), the big number is not so big: 5.0% A 5 handle is a huge development, even with the core remaining sligh

Let's personalize your content