What If You Invested at the Peak Right Before the 2008 Crisis?

A Wealth of Common Sense

FEBRUARY 27, 2024

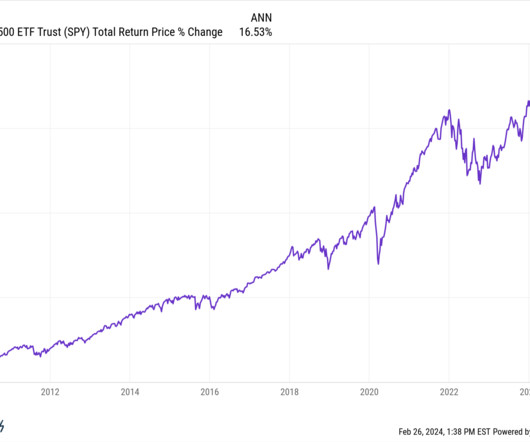

Despite 5% short-term interest rates and stickier inflation than some people would like and the Fed potentially pushing back interest rate cuts for a few months and the new True Detective seasons being a massive disappointment…the S&P 500 continues to take out new all-time highs. By my count there have already been a baker’s dozen in 2024 alone.1 Here are the new highs by year since 2015: 2015: 10 2016: 1.

Let's personalize your content