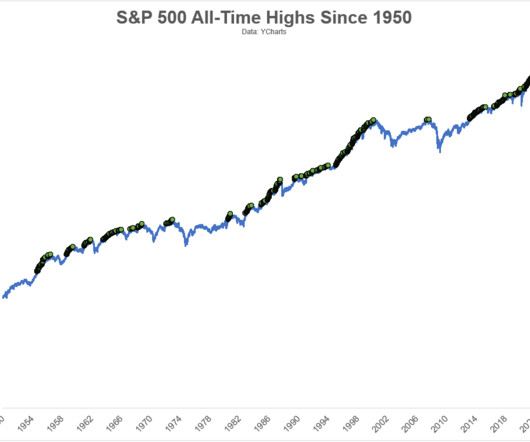

All-Time Highs Usually Lead to More All-Time Highs in the Stock Market

A Wealth of Common Sense

FEBRUARY 8, 2024

A reader asks: Investing at all time highs is counterintuitive. Does it produce great returns because the market is forward-looking and investors are momentum investors? It doesn’t seem to make sense to buy just before a long severe bear market. I understand the worry here. All-time highs seem scary because every stock market crash in history started from one.

Let's personalize your content