Why the Stock Market Makes You Feel Bad All the Time

A Wealth of Common Sense

MARCH 28, 2023

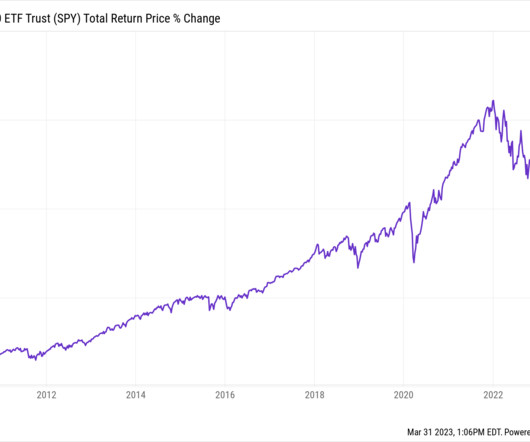

The last new all-time high for the S&P 500 was on January 3, 2022. That means it’s been almost 450 days since we’ve experienced new highs in the stock market. That feels like a long time. But based on the history of bear markets, it’s really not all that long. It might be a while until we hit new highs again if we use history as a guide.

Let's personalize your content