The Case For International Diversification

A Wealth of Common Sense

MAY 9, 2023

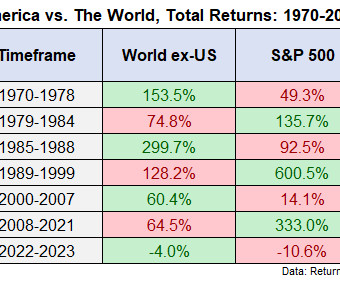

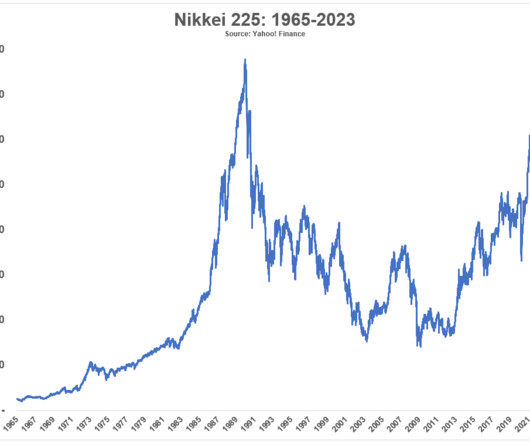

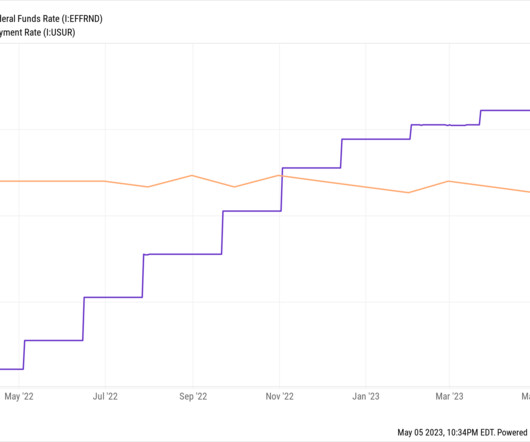

The United States makes up nearly 60% of the global stock market by market capitalization: The dominance of American stocks over the rest of the world wasn’t just a 20th-century phenomenon either. The performance over the past decade and change shows U.S. stocks winning hands down over our foreign counterparts: Many investors look at these numbers and wonder: What’s the point of owning international stocks i.

Let's personalize your content