The Fed is Breaking Things (and it could get worse)

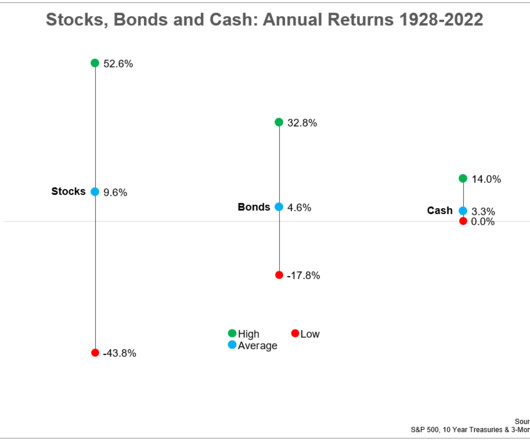

The Big Picture

MARCH 10, 2023

Armchair quarterbacking the decisions of the Federal Reserve long ago became a blood sport. With the benefit of hindsight, we all are genius central bankers. I particularly loathe managers who lay all the woes of the world at the feet of the Federal Reserve. For more than a century, America’s central bank has been a key part of the investing environment, and it’s your job as an active manager to incorporate their probable policy decisions into your strategy.

Let's personalize your content