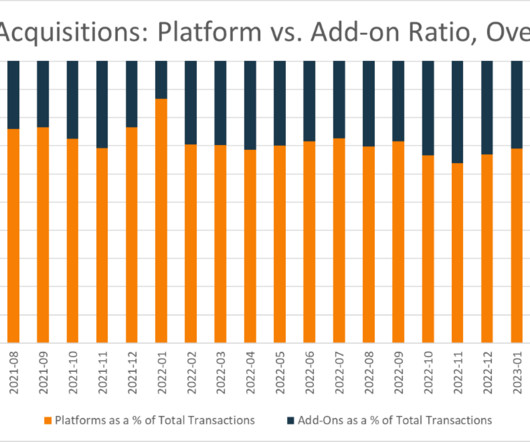

Platform acquisitions drop from 2021 to 2023 as add-ons surge

Private Equity Info

NOVEMBER 14, 2023

Private equity firms are shifting towards smaller M&A deals, with add-ons becoming the dominant investment strategy.

Private Equity Info

NOVEMBER 14, 2023

Private equity firms are shifting towards smaller M&A deals, with add-ons becoming the dominant investment strategy.

The Motley Fool

NOVEMBER 12, 2023

Image source: Getty Images The holidays themselves may not be here quite yet, but it's fair to say that the holiday shopping season is in full swing. And this year, consumers seem to be going all in. Data from RetailMeNot finds that shoppers are planning to spend considerably more this year on the holidays compared to last year -- $932 versus $725. And chances are, a lot of people will do a fair share of their shopping on Black Friday.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Private Equity Insights

NOVEMBER 16, 2023

Argo Group International Holdings, Ltd. (“Argo”) today announced the completion of Brookfield Reinsurance’s acquisition of Argo in an all-cash transaction valued at approximately $1.1bn. Under the terms of the transaction, Brookfield Reinsurance acquired all issued and outstanding common shares of Argo at a price of $30 per share. Argo’s common shares have ceased trading on the New York Stock Exchange.

PE Hub

NOVEMBER 15, 2023

In conjunction with this deal, YPTC founder and President Eric Fraint will be retiring from the company in early 2024. The post Accounting firm Your Part-Time Controller names investment from Pamlico appeared first on PE Hub.

The Big Picture

NOVEMBER 15, 2023

Markets screamed higher yesterday after a benign CPI report showed a 0.0% monthly price increase and inflation falling to 3.2% year over year. After a big gap opening, latecomers piled in; many had been sitting on the sidelines following a challenging 2022, while others got panicked out during the 10% October drawdown. It was a classic fear-driven error, a combination of bad market timing and poor impulse control.

The Motley Fool

NOVEMBER 14, 2023

Shares of electric air taxi company Archer Aviation (NYSE: ACHR) soared 10.2% through 10:15 a.m. ET on Tuesday, marking its second straight day of gains after Deutsche Bank predicted the stock would double. On Monday, the German investment bank made headlines when it reiterated its $12 price target on Archer stock -- a more than 130% gain over yesterday's closing price.

Private Equity Central brings together the best content for private equity professionals from the widest variety of industry thought leaders.

PE Hub

NOVEMBER 15, 2023

The deal is in connection with MAV's financial and corporate restructuring through proceedings under the CCCA. The post MAV Beauty Brands agrees to sell assets to Nexus Capital appeared first on PE Hub.

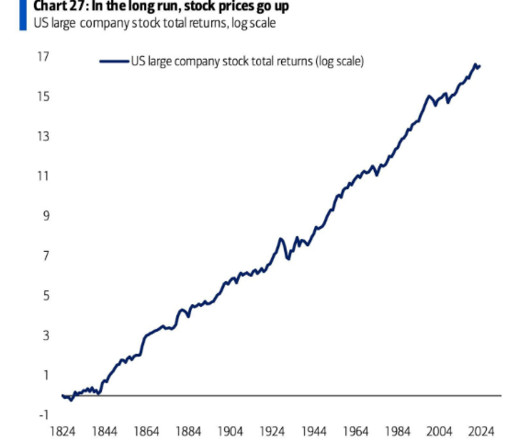

A Wealth of Common Sense

NOVEMBER 17, 2023

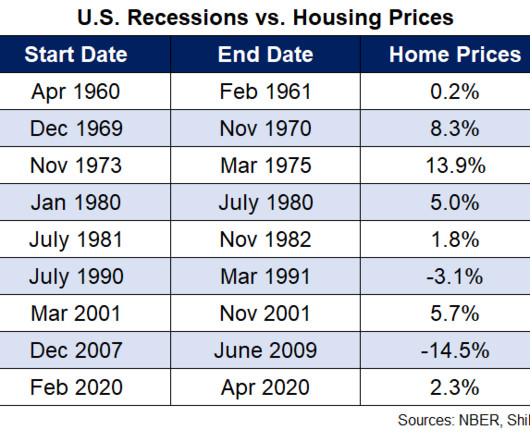

I saw a chart this week from Bank of America that more or less sums up my entire investment philosophy: In the long run, stock prices go up. I view the stock market as a way to invest in innovation, profits, progress and people waking up in the morning looking to better their current situation. While I love the fact that this chart illustrates my long-term philosophy it’s a bit misleading.

The Motley Fool

NOVEMBER 16, 2023

Shopify (NYSE: SHOP) stock is back. Or maybe it never really faded all that much. But with the logistics business now sold off, it's easier to focus on what Shopify has always done best: software for the e-commerce industry. Of course, not all is perfect, and it's still easy to poke holes in the Shopify investment thesis -- with its current rich valuation among the top concerns.

Private Equity Insights

NOVEMBER 14, 2023

Bahrain-based alternative asset manager Investcorp is aiming to raise 2bn to 4bn yuan ($274m-$548m) for its first private equity fund in the Chinese currency, its executive said, to explore buyout opportunities in the country. Investcorp plans to apply in the next few months for a license with Chinese regulatory bodies that will allow it to start raising funds from domestic institutions next year, Investcorp’s co-chief executive officer Hazem Ben-Gacem said. “I hope over time, we wil

PE Hub

NOVEMBER 15, 2023

USHG's existing backers include Cota Capital, NRD Capital and restaurant group Bobby Cox Companies. The post Enlightened Hospitality Investments backs restaurant tech company Qu appeared first on PE Hub.

FinSMEs

NOVEMBER 17, 2023

Workshop, an Omaha, NE-based provider of an email platform for internal communications, raised $12M in Series A funding. The round was led by McCarthy Capital with participation from Ludlow Ventures and M25. The company intends to use the funds to accelerate the innovation of its solution for internal email, recruit additional talent for the engineering […] The post Workshop Raises $12M in Series A Funding appeared first on FinSMEs.

The Motley Fool

NOVEMBER 16, 2023

Retailing is a difficult business characterized by high competition levels and low profit margins. But that's not the case for tech companies that help connect retailers with buyers. Done right, the middleman selling approach can translate into predictable sales growth and impressive cash flow -- all with relatively low financial risk. Etsy (NASDAQ: ETSY) and Shopify (NYSE: SHOP) are both set up to take advantage of these favorable economics.

Top 1000 Funds

NOVEMBER 12, 2023

ESG-momentum matters when it comes to outperformance according to new research by Pictet Asset Management's head of sustainability Eric Borremans who says investors should sharpen their ESG lens and use active ownership to trigger positive change.

PE Hub

NOVEMBER 16, 2023

Waud Capital will retain a majority stake in HSI. The post Neuberger Berman takes minority stake in environmental and health compliance software provider HSI appeared first on PE Hub.

FinSMEs

NOVEMBER 17, 2023

Inclusively, a New Orleans, LA-based workforce inclusion platform, raised $13M in Series A funding. The round was led by Firework Ventures, with participation from existing investors, including Benson Capital. The company intends to use the funds to accelerate access to its new workplace personalization platform, Retain, meeting growing need for flexibility and accommodations.

The Motley Fool

NOVEMBER 14, 2023

Fool.com contributor Parkev Tatevosian reviews Plug Power (NASDAQ: PLUG) stock following the massive stock price crash after it announced a quarterly investor update. *Stock prices used were the afternoon prices of Nov. 12, 2023. The video was published on Nov. 14, 2023. 10 stocks we like better than Plug Power When our analyst team has a stock tip, it can pay to listen.

Axial

NOVEMBER 16, 2023

Small business exits fail half the time. But many of the reasons behind why they fail are preventable. Last week, Axial CEO Peter Lehrman presented on this topic at Main Street Summit , a two-day event for SMB owners, operators, and investors. Peter presented on failed exits – when business owners that engage in a process to sell their business aren’t successful – and what business owners can do to prevent them.

PE Hub

NOVEMBER 14, 2023

Based in Fort Myers, Florida, Juniper is a commercial landscaping platform. The post Bregal-backed Juniper Landscaping buys landscaping maintenance firm Shooter and Lindsey appeared first on PE Hub.

FinSMEs

NOVEMBER 17, 2023

Ingenious.Build, a Nashville, TN-based technology company specializing in project management software for real estate development and construction, raised $37M in Series A funding. The round was led by Morpheus Ventures and Navitas Capital alongside Koch Real Estate Investments, with participation from American Family Ventures, JLL Spark Global Ventures and Crow Holdings.

The Motley Fool

NOVEMBER 14, 2023

Fool.com contributor Parkev Tatevosian highlights two artificial intelligence (AI) stocks that Warren Buffett owns in his Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) portfolio. *Stock prices used were the afternoon prices of Nov. 12, 2023. The video was published on Nov. 14, 2023. 10 stocks we like better than Apple When our analyst team has a stock tip, it can pay to listen.

A Wealth of Common Sense

NOVEMBER 12, 2023

Jesse Livermore once said, “Another lesson I learned early is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.” Fair point. Human nature is the one constant across all market environments. On the other hand, Warren Buffett once said, “If past history was all that.

PE Hub

NOVEMBER 15, 2023

Based in Des Plaines, Illinois, Data Clean is a specialized facility maintenance services firm. The post Angeles Equity Partners-backed Data Clean buys environment cleaning business Sealco appeared first on PE Hub.

FinSMEs

NOVEMBER 16, 2023

Deep Sky, a Montreal, Canada-based carbon removal project developer, raised C$75M in Series A funding. The round included conversion of its $17.7M seed note and $57.5M in new capital co-led by Brightspark Ventures and Whitecap Venture Partners, with major participation from Investissement Québec ($25M), as a mandate of the government of Quebec, OMERS Ventures, and Business Development Bank of Canada (BDC)’s Climate […] The post Deep Sky Raises C$75M in Series A Funding appeared first

The Motley Fool

NOVEMBER 14, 2023

Image source: Getty Images The Supplemental Nutrition Assistance Program (SNAP) is a federal initiative to help families cover their monthly food costs. SNAP has some specific income and work eligibility requirements , but in general, the program can significantly help lower-income families who need extra help buying food. More than 22 million U.S. households -- 12.5% of the population -- receive SNAP benefits, according to Pew Research Center.

A Wealth of Common Sense

NOVEMBER 16, 2023

A reader asks: I keep hearing about the Magnificent 7 stocks are carrying the stock market this year while the rest of the stocks are sucking wind. Does this even matter? I get that these stocks could fall and bring the market down with them but should we be worried about this level of concentration? It’s true the Magnificent 7 stocks — Amazon, Apple, Facebook, Google, Microsoft, Nvidia and Tesla — are.

PE Hub

NOVEMBER 13, 2023

Baird served as financial advisor to DCG and a Hogan Lovells team led by Bill Curtin served as legal advisor. The post Car dealership M&A advisor DCG secures investment from Kaltroco appeared first on PE Hub.

FinSMEs

NOVEMBER 14, 2023

Keychain, a NYC-based manufacturing platform for the packaged goods industry, raised $18 million in seed funding. The round was led by Lightspeed Venture Partners, with participation from BoxGroup, Afore Capital, SV Angel, and over 20 CPG industry professionals. Founded by Handy founders Oisin Hanrahan and Umang Dua, respectively, CEO and CRO, Keychain is a platform for CPG manufacturing that works […] The post Keychain Raises $18M in Seed Funding appeared first on FinSMEs.

The Motley Fool

NOVEMBER 14, 2023

Solar energy stocks had a great day on Tuesday as the market reacted to the potential for lower interest rates in the future. Stocks were up across the board, but Sunrun (NASDAQ: RUN) led the way, climbing as much as 19.6%; SunPower (NASDAQ: SPWR) jumped 12.9%; Enphase Energy (NASDAQ: ENPH) rose 14.4%, and SolarEdge Technologies (NASDAQ: SEDG) popped 11.4%.

American Investment Council

NOVEMBER 14, 2023

Washington, D.C. – The American Investment Council (AIC) released a report today, authored by PitchBook , highlighting the success of private credit managers in enhancing the health and performance of American businesses. Private credit has increased access to capital for small- and medium-sized businesses across the nation. Private credit managers are demonstrating a strong performance, consistently yielding returns above 10% – significantly higher than traditional fixed income investments.

PE Hub

NOVEMBER 17, 2023

The four add-ons are Summit Environmental Technologies, Fremont Analytical, Orange Coast Analytical and Chester LabNet. The post MSCP finds opportunities with environmental labs, scoops up four add-ons to Alliance Technical Group appeared first on PE Hub.

FinSMEs

NOVEMBER 16, 2023

Gravity, a NYC-based electric vehicle (EV) infrastructure company, raised an undisclosed amount in Seed funding. The round was led by GV (Google Ventures). The company intends to use the funds to expand operations and its business reach. Led by Moshe Cohen, Gravity is a provider of an EV infrastructure and energy management solutions. Its complete […] The post Gravity Raises Seed Funding Led by GV appeared first on FinSMEs.

The Motley Fool

NOVEMBER 14, 2023

"It's the economy, stupid," is a maxim of long-standing in the political world. It's also front of mind for many investors in real estate investment trusts (REITs), as evidenced by the dramatic upswings of many stocks in the sector on Tuesday. There was some highly encouraging news about inflation, and the market reacted accordingly and strongly. Many REITs booked notable gains on the day, no matter what niche or niches they specialize in.

American Investment Council

NOVEMBER 15, 2023

Recently, Anthos Therapeutics, a Massachusetts-based biopharmaceutical company supported by private equity announced at a meeting of the American Heart Association that their new drug demonstrated a potential to significantly reduce the risk of blood clots. Backed by AIC member Blackstone Life Sciences, this new treatment could provide a safer alternative for the 12.1 million Americans expected to suffer from atrial fibrillation by 2030.

Let's personalize your content