Scarcity is an Ally of Appreciation

A Wealth of Common Sense

JULY 31, 2022

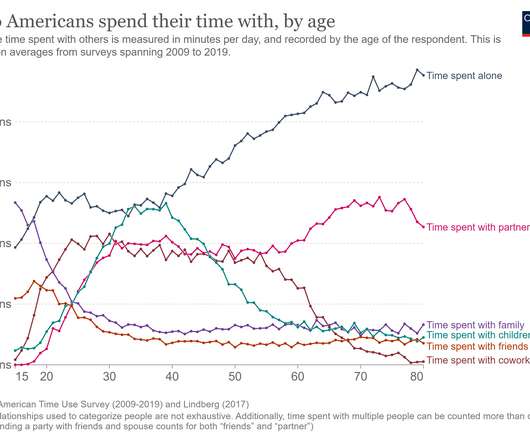

Derek Thompson posted this incredible chart from Our World in Data on who Americans spend their time with, by age: These are average numbers but based on this chart the time spent with: Your family peaks at around 15 years old. Your friends peaks at around 18 years old. Your co-workers peaks at around 30 years old. Your kids peaks at around 40 years old.

Let's personalize your content