Why the market is bouncing

The Reformed Broker

AUGUST 8, 2022

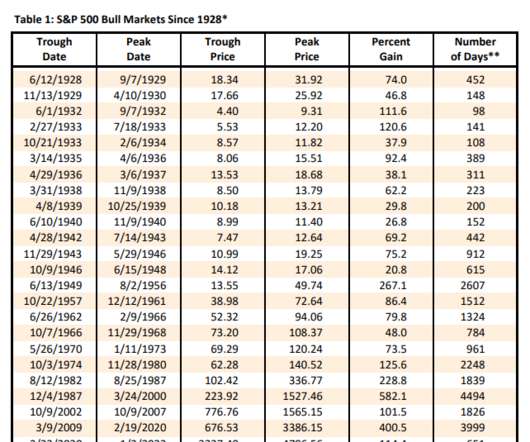

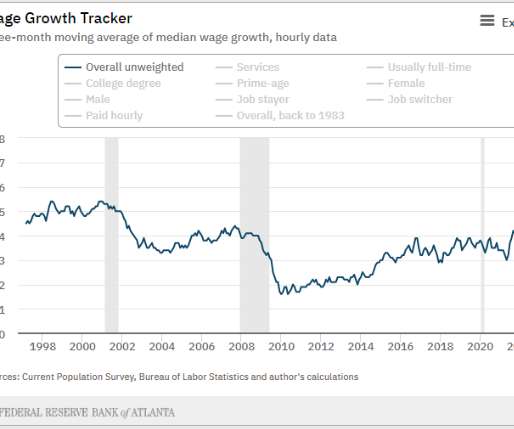

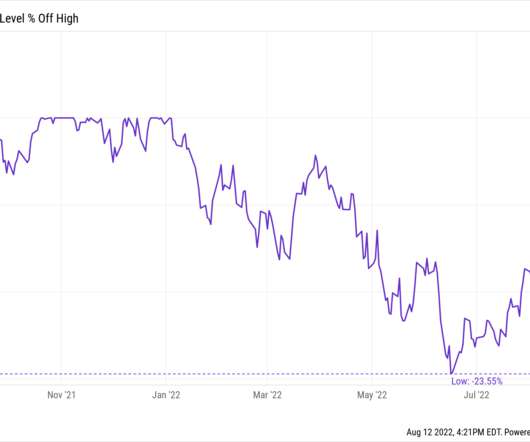

Why did the stock market bounce this summer? Everyone has their explanation: The Fed might pivot! Inflation readings have now peaked! Oil prices are down 25%! China is ending the lockdowns! The labor market is staying strong! Earnings are still coming in better than expected! All true. But there’s an even better reason that doesn’t invalidate any of the ones I’ve posted above.

Let's personalize your content