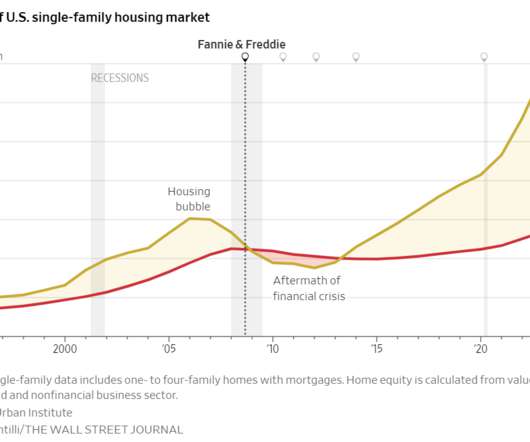

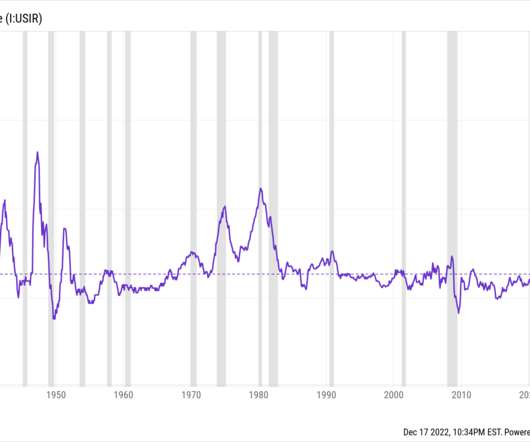

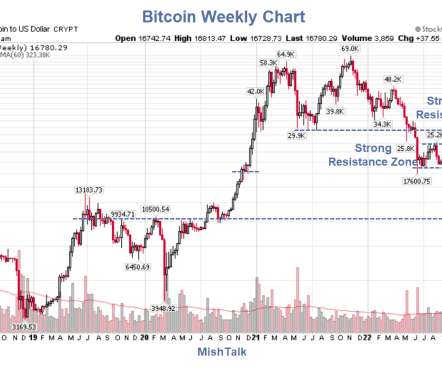

An Incredible Chart of the Housing Market

A Wealth of Common Sense

DECEMBER 20, 2022

Think back to 2010. After you got done signing up for some new app called Instagram and finished 17 shows and movies about vampires, maybe you finished reading The Girl With the Dragon Tattoo trilogy. Once all that pop culture consumption was done, you would have needed some non-fiction to keep up with the intellectual crowd so you moved on to The Big Short by Michael Lewis.

Let's personalize your content