How This Ends

A VC: Musings of a VC in NYC

MAY 22, 2022

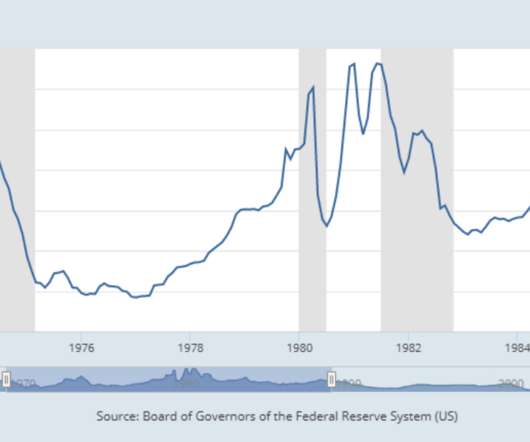

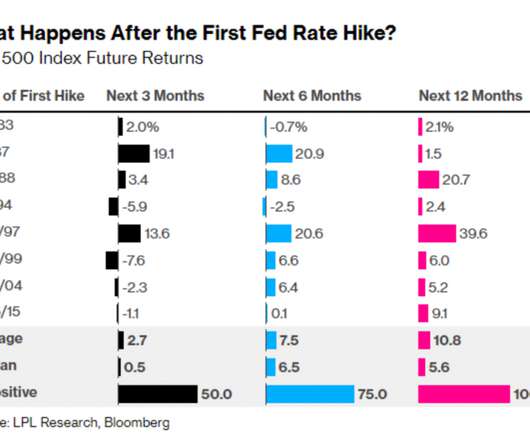

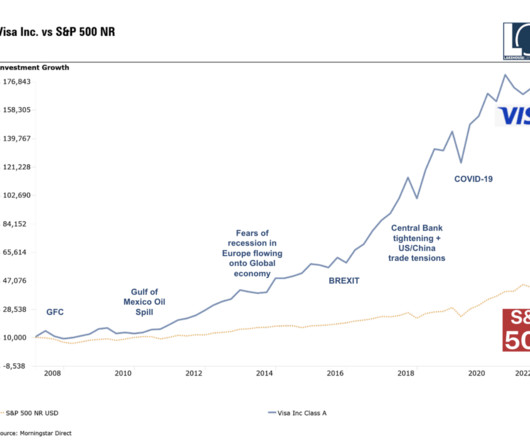

Back in February of last year, I wrote a blog post with the same title and said this about the asset price bubble we were living in and investing in over the last few years: The big question is how does this end? I believe it ends when the Covid 19 pandemic is over and the global economy recovers. Those two things won’t necessarily happen at the same time.

Let's personalize your content