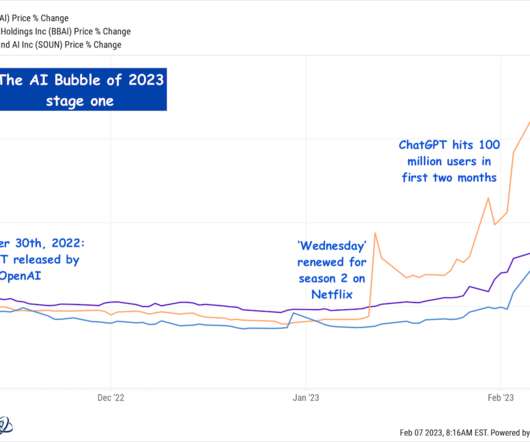

The AI Bubble of 2023

The Reformed Broker

FEBRUARY 7, 2023

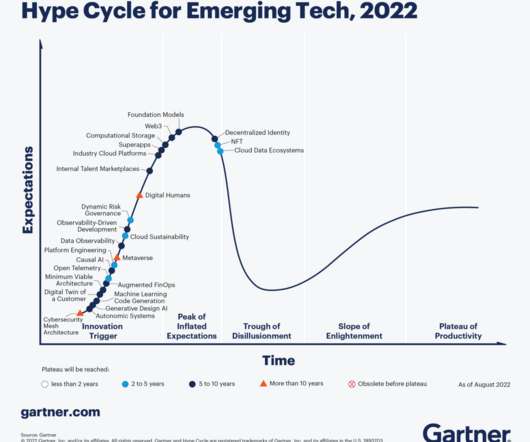

“When I see a bubble forming I rush in to buy, adding fuel to the fire. That is not irrational.” – George Soros, 2009 I’ve spent 25 years watching, trading and investing in the stock market. The repetition of patterns is amazing. In every generation we see new bubbles, which form when a new innovation comes along and everyone gets excited about the future.

Let's personalize your content