How Much is Enough to Retire Comfortably?

A Wealth of Common Sense

FEBRUARY 21, 2023

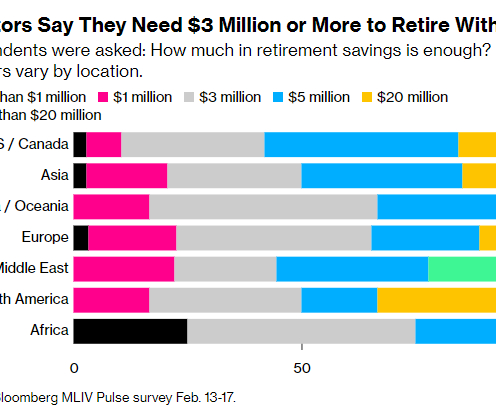

Bloomberg asked investors from around the globe one of the most important questions in all of personal finance: How much is enough to retire comfortably? The results were a tad on the high side: The average number came in somewhere between $3 million and $5 million. One-third of respondents said $3 million while another third said it was closer to $5 million.

Let's personalize your content