Are We Living in The Roaring 20s?

A Wealth of Common Sense

MARCH 26, 2024

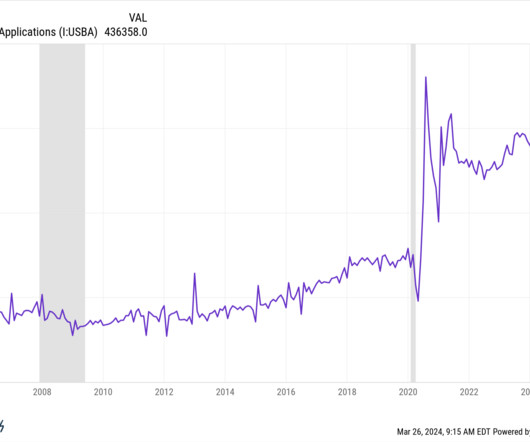

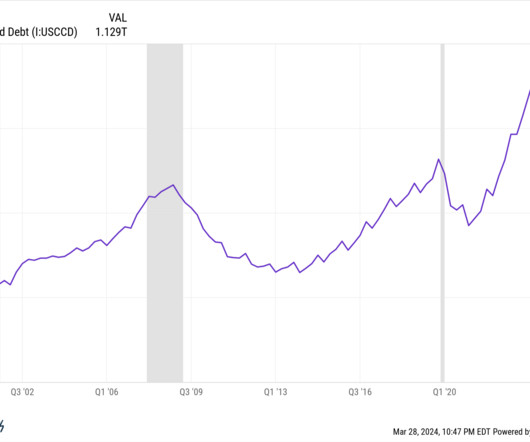

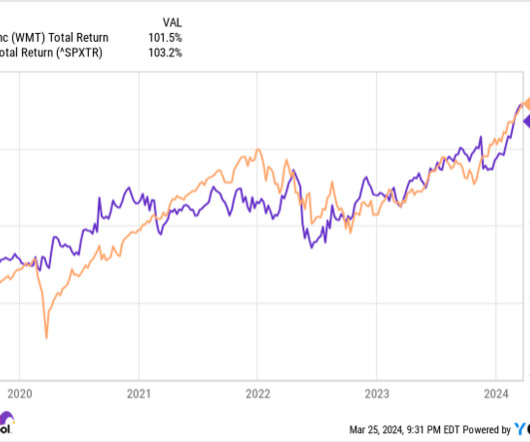

In March 2020, at the height of uncertainty at the outset of the pandemic, I wrote about what it took to get to the roaring 1920s. This chart sums it up nicely: Here’s what I wrote at the time: How many people at the time would have predicted during the war/pandemic/recession/depression years that the 1920s would be one of the most innovative, prosperous periods our country had ever seen?

Let's personalize your content