How to Lie With Charts

A Wealth of Common Sense

APRIL 8, 2024

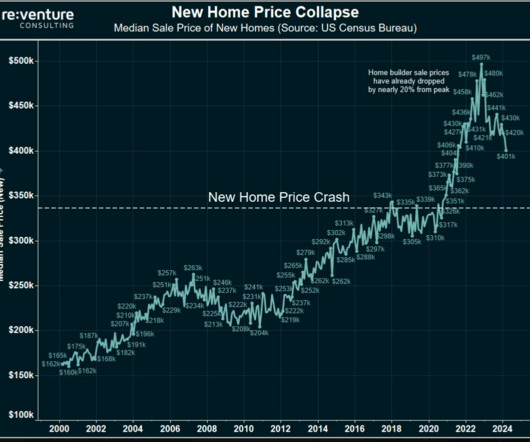

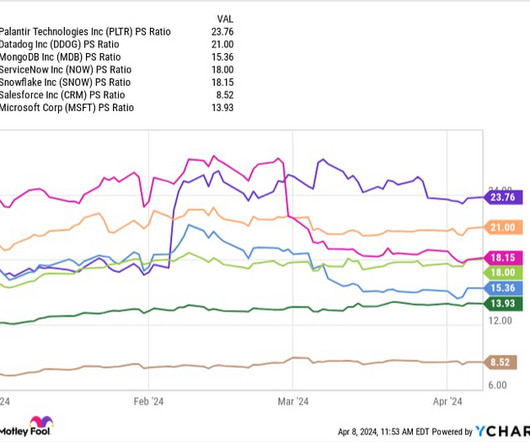

A reader sent me the following chart asking for my thoughts: I honestly don’t know who the creator of this chart is. I don’t know the intention of it either but the fact that the title contains the word collapse makes it sound scary. Knowing that housing prices in the U.S. are at all-time highs makes this chart seem suspect, but the data checks out.

Let's personalize your content