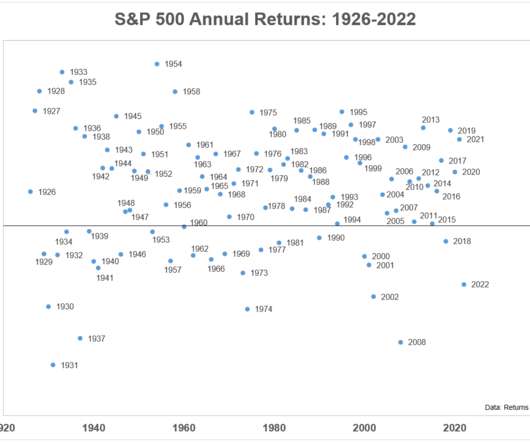

Is It Realistic to Have 100% of Your Portfolio in Stocks?

A Wealth of Common Sense

JANUARY 19, 2023

A reader asks: Is it crazy to be 100% in stocks from age 32 to sometime in my 50s for my retirement accounts? And another reader asks a similar question: I don’t get why people work a 30+ year career while investing in stocks only to glide path into a heavier bond allocation around retirement. Why not just stay 100% in stocks, benefit from share price appreciation and collect dividends for life?

Let's personalize your content